Dividend Paying Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

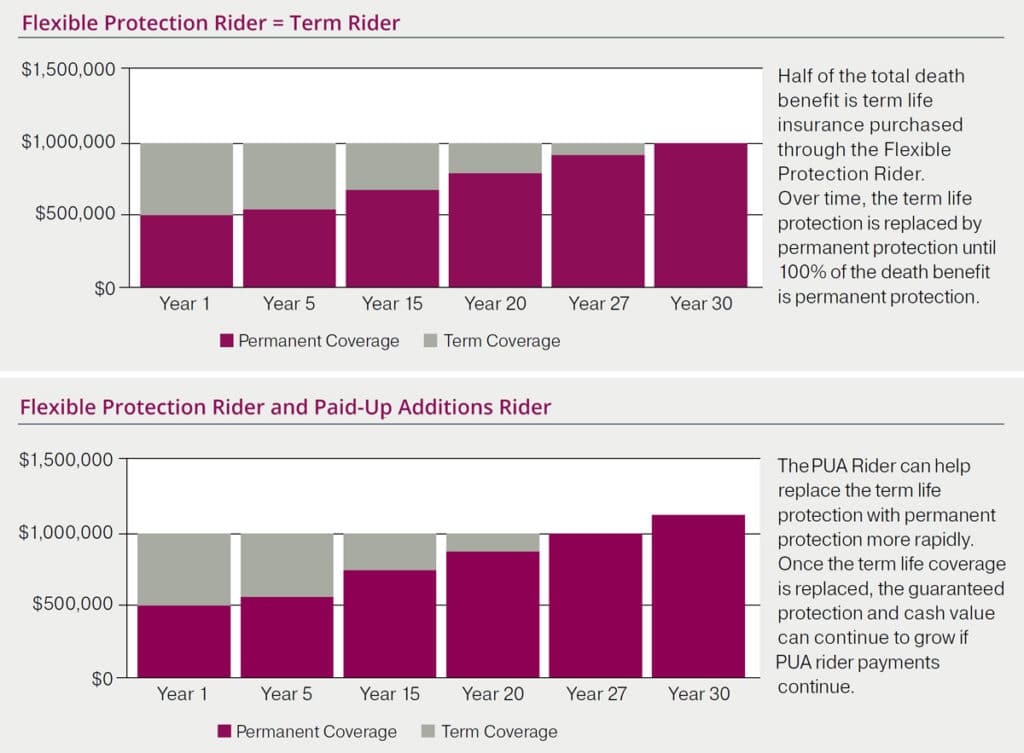

Whole life insurance that pays dividends is also known as “participating life insurance” or a “participating policy contract. ”. This simply means that the policy owners “participate” in sharing in the profits of the insurance company. Participating policies are whole life policies that pay dividends. Term life insurance, universal.

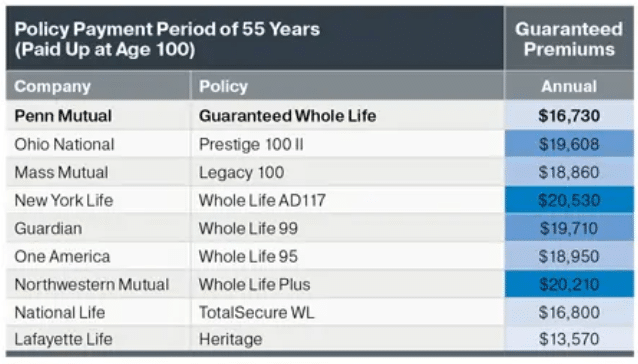

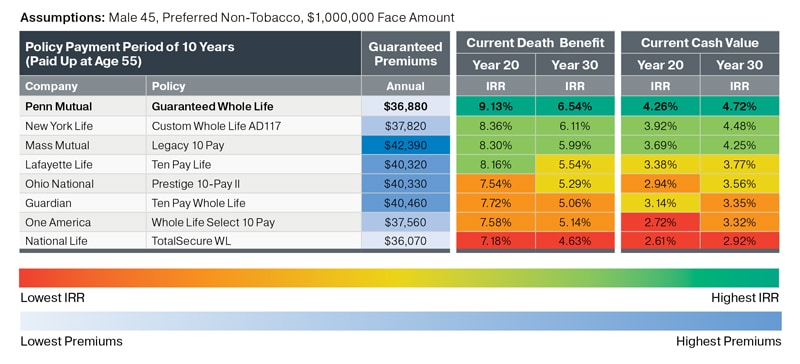

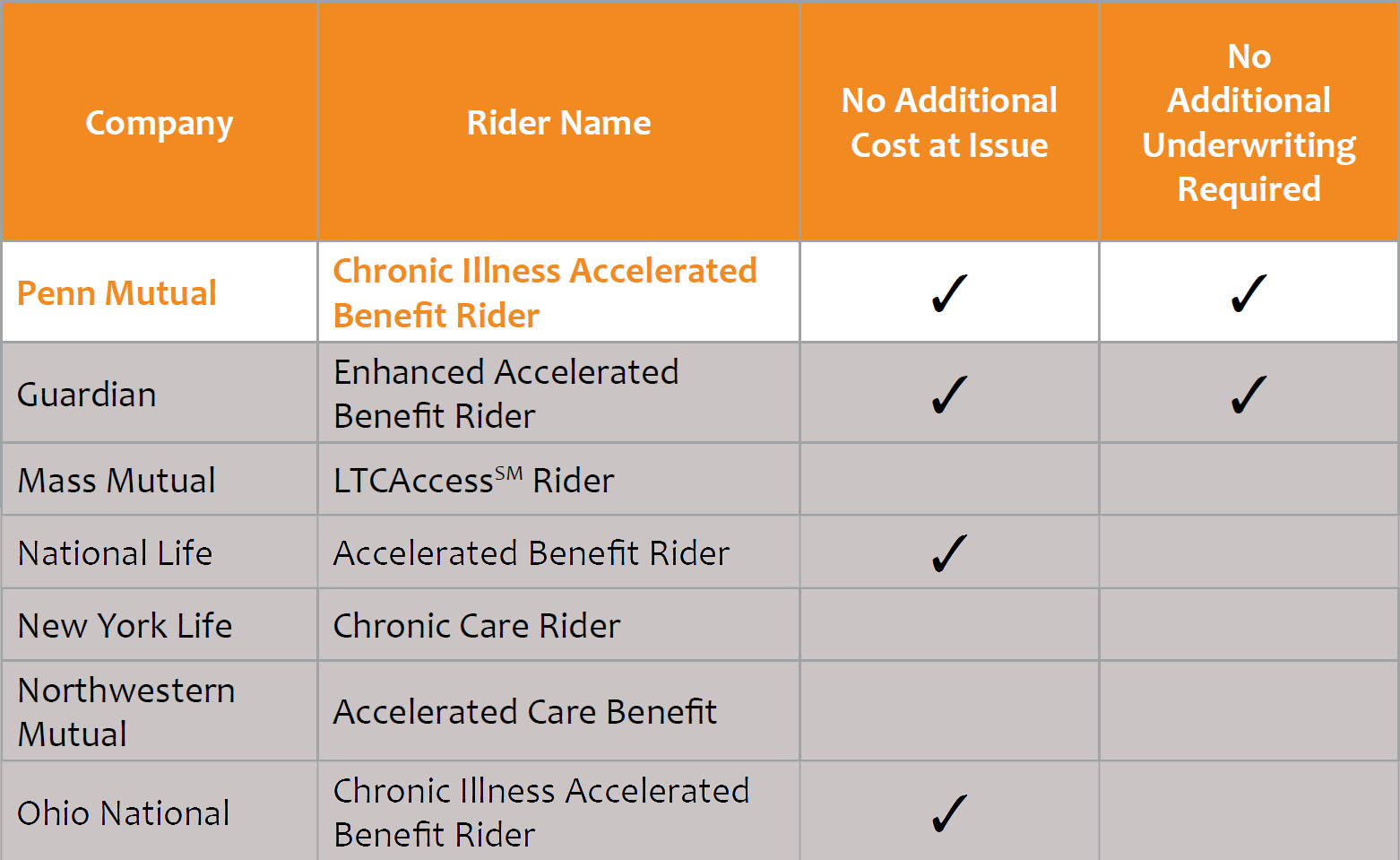

* the interest credit ($4,210) is equal to the 2022 dividend interest rate for unborrowed funds for most whole life policies with direct recognition (5. 00%) multiplied by the policy value at the beginning of the policy year after mortality & expense charges are taken out ($84,191). 18 rowsupdated march, 2022. Whole life insurance is a type of permanent or “cash value” life insurance. The dividend option to reduce/pay premiums. Dividends are an annual payment that policyholders receive from a participating life insurance policy. The amount you receive depends on how much coverage you have and on the company’s revenue, operating expenses, and rate of investment returns. Essentially, dividends from whole life insurance are like an annual bonus you get just for owning. The key differences between term vs. Whole life insurance is the period of level premiums and the ability to build cash value.

Top 10 Best Dividend Paying Whole Life Insurance Companies

What is Dividend Paying Whole Life Insurance? • The Insurance Pro Blog

Understanding Whole Life Insurance Dividend Options

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Dividends from Whole Life Insurance Explained - BankingTruths.com

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Top 10 Best Dividend Paying Whole Life Insurance Companies [2021 Edition]

![Dividend Paying Whole Life Insurance Top 10 Best Dividend Paying Whole Life Insurance Companies [2021 Edition]](https://www.insuranceandestates.com/wp-content/uploads/Dividend-Paying-Whole-Life-Insurance-1-e1550501953851.jpg)

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Post a Comment for "Dividend Paying Whole Life Insurance"