Life Insurance Whole Life Policy

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

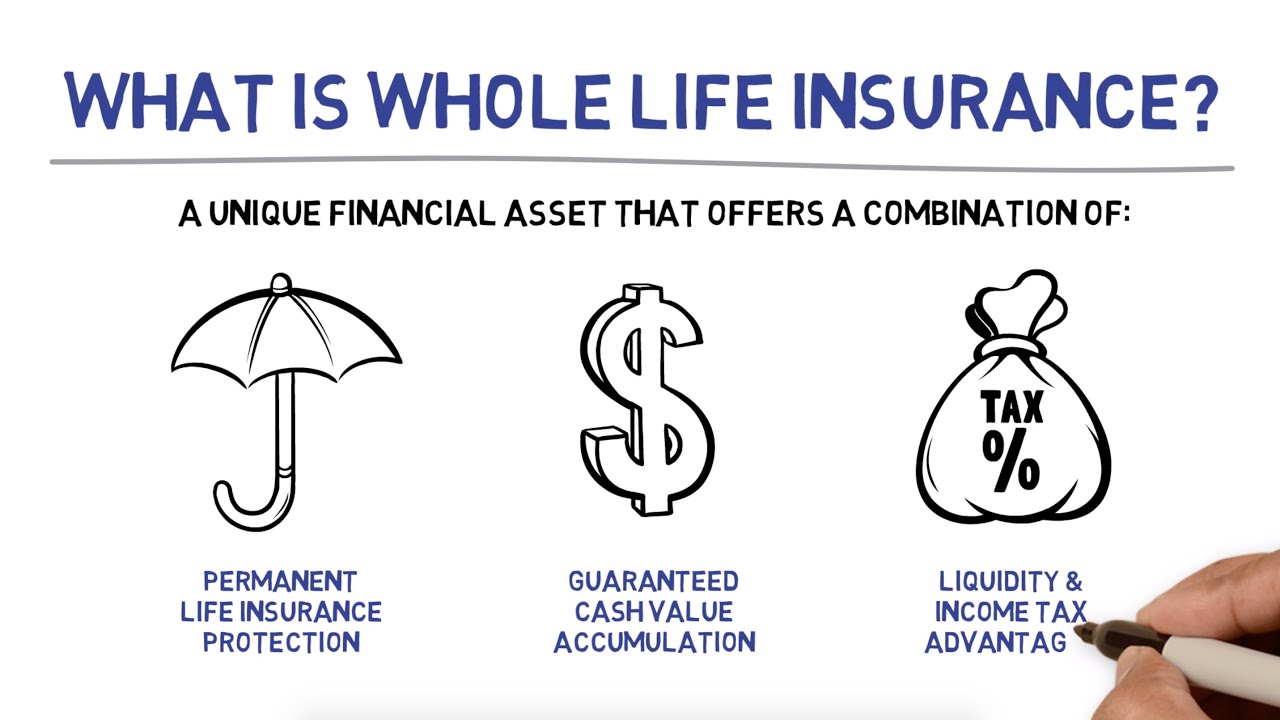

Advantages of term life insurance. Term life insurance is simpler and easier to understand than permanent life insurance plans. It’s also a less expensive option when compared to whole life insurance. What is whole life insurance?

You have to pay a higher premium as compared to the premium of a term insurance plan. The advantage here is that the premium amount is fixed. In addition, along with the death benefit, you also get income benefits, as the cash amount that. Guaranteed issue whole life insurance. Guaranteed issue whole life insurance does not require you to take a medical exam or answer health questions. Coverage limits are $5,000 to $25,000, and rates are locked in while the policy accumulates cash. Guaranteed issue whole life insurance features: No health questions or medical exams required Suze orman is a big supporter of term life insurance policies, and she firmly believes that those types of policies are the best ones to have.

SG Budget Babe: Should I buy Term or Whole Life Insurance?

Is Whole Life Insurance a Good Investment? • The Insurance Pro Blog

Whole life insurance - definition and meaning - Market Business News

How Does Whole Life Insurance Work As An Investment

Life Insurance Types Explained [Term Life, Whole Life, Universal Life]

![Life Insurance Whole Life Policy Life Insurance Types Explained [Term Life, Whole Life, Universal Life]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Whole-Life-Insurance-Key-Factors.png)

Whole Life Insurance: Check & Compare Whole Life Insurance Online

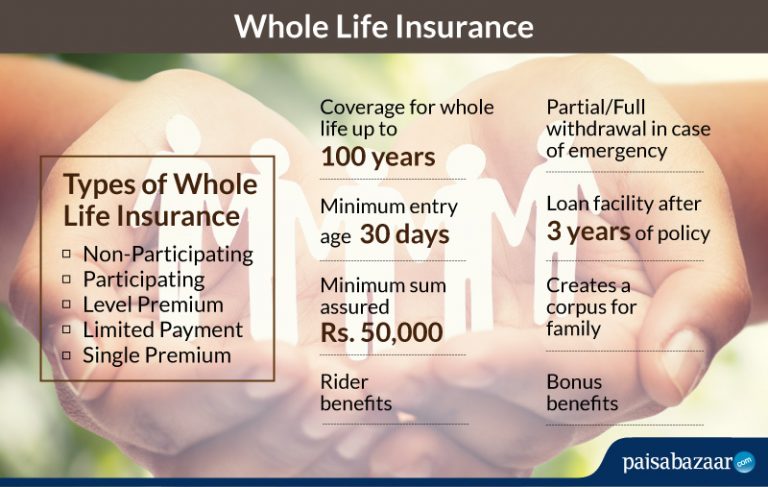

Features & Benefits of Permanent Whole Life Insurance - Paisabazaar.com

20 Online Whole Life Insurance Quotes and Pictures | QuotesBae

Getting to Know Permanent Whole Life Insurance - Sproutt life insurance

Whole Life Insurance - YouTube

Post a Comment for "Life Insurance Whole Life Policy"