Whole Life Insurance For Retirement

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

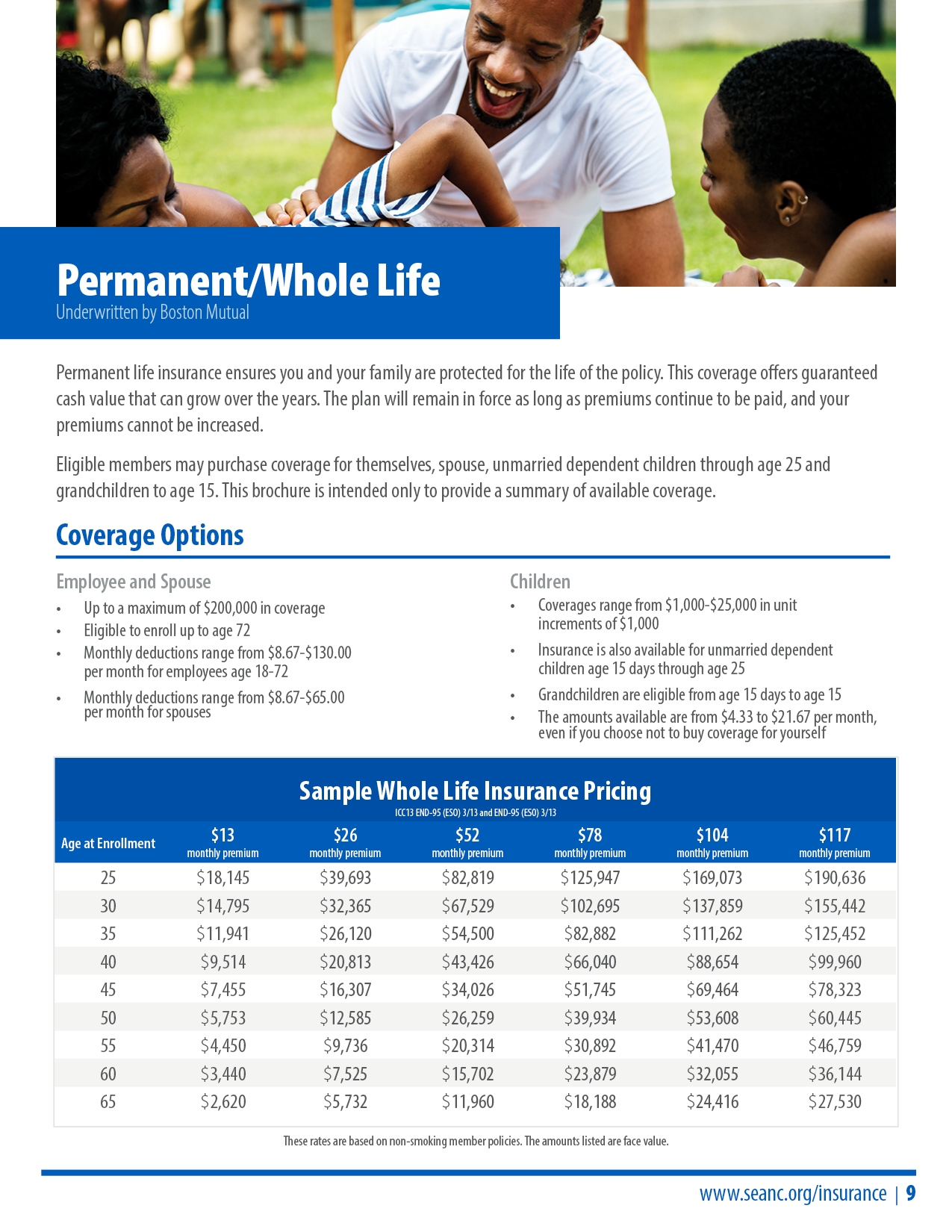

The finer details will vary by product and company, but these provisions are becoming more and more common with whole life insurance. Everyone needs to keep a certain amount of safe and liquid reserves, especially on the way to retirement. But a number of academics say that whole life, a form of permanent life insurance that builds cash value, can buttress investment portfolios and even boost retirement income if used correctly. Like any life insurance policy, the main reason to buy whole life insurance is the death benefit protection for finances of those who depend on you for support.

Any permanent life insurance policy with a cash value, such. Compared with term life insurance, whole life insurance is costly— between five and 15 times as expensive, by investopedia’s estimate. Second, a permanent death benefit supported through whole life insurance can be integrated into a retirement income plan by helping the retiree to justify the decision to buy an income annuity and. Withdraw cash from the policy. Take a loan against the policy. When you take a withdrawal from a whole life insurance policy it means that you are removing the cash from the policy. The option to take withdrawals is available for. The cost of whole life insurance tends to be much higher than term life insurance. Cash value growth tied to the performance of s&p 500 index, with average annual return of 10. 1% in the past 30 years.

Whole Life Insurance For Retirement [Guaranteed Returns Provide

Is Whole Life Insurance a Good Investment for Retirement

See why whole life insurance a good investment for retirement, life

Using Whole Life Insurance for Retirement Income? Case Study | IBC

AARP Life Insurance Seniors | Term and Whole Which is Better?

Return of Premium with Senior Life Insurance Company - Best Insurance

How To Use Whole Life Insurance For Retirement - The Best Funeral

Permanent Life (Whole… | State Employees Association of North Carolina

Retirement Income Don'ts: Whole Life Insurance | Taatjes Financial Group

Post a Comment for "Whole Life Insurance For Retirement"