Participating Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

As its name suggests, whole life insurance can cover you for your entire life. That’s in contrast to term insurance , which covers you for a. In 2021 its market share was 7. 49%, followed by new york life group. One of the most important aspects to consider is getting a:

Participating means that you participate in the performance of the company. The better the company you bought does, then the more they will share with you. You will receive a dividend that helps the policy grow. Non participating whole life insurance is typically seen in smaller final expense insurance policies, although there are some companies that offer larger whole life policies that do not receive dividends, such as metlife. A whole life policy is a unilateral contract between the policyholder and the insurance company. It promises that if the policyholder pays the specified premium, then a specified death benefit will be paid and that the cash value within the policy will equal the death benefit at a specified age (at which point the policy is said to “endow”). Non participating life insurance is the opposite of participating life insurance. With an absence of dividends and company ownership, these simplified whole life plans are typically less expensive and easier to select. Non par policies are usually sold by non mutual insurers.

Participating Whole Life Insurance - Whole Vs Term Life

Participating Whole Life Insurance: Things to Know [All In The Dividends]

![Participating Whole Life Insurance Participating Whole Life Insurance: Things to Know [All In The Dividends]](https://topwholelife.com/wp-content/uploads/2019/02/Participating-Whole-Life-Insurance_-Things-to-Know-768x1920.jpg)

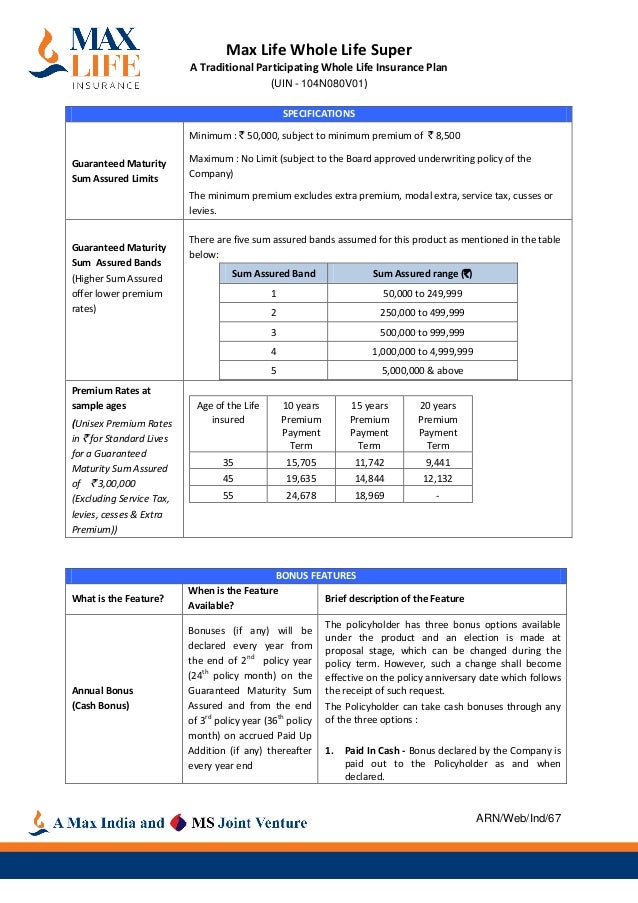

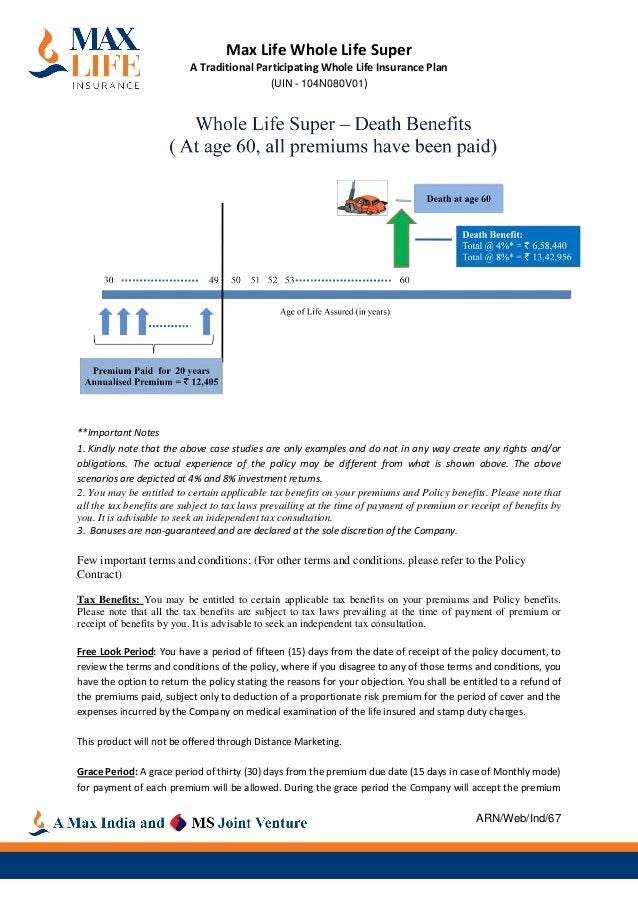

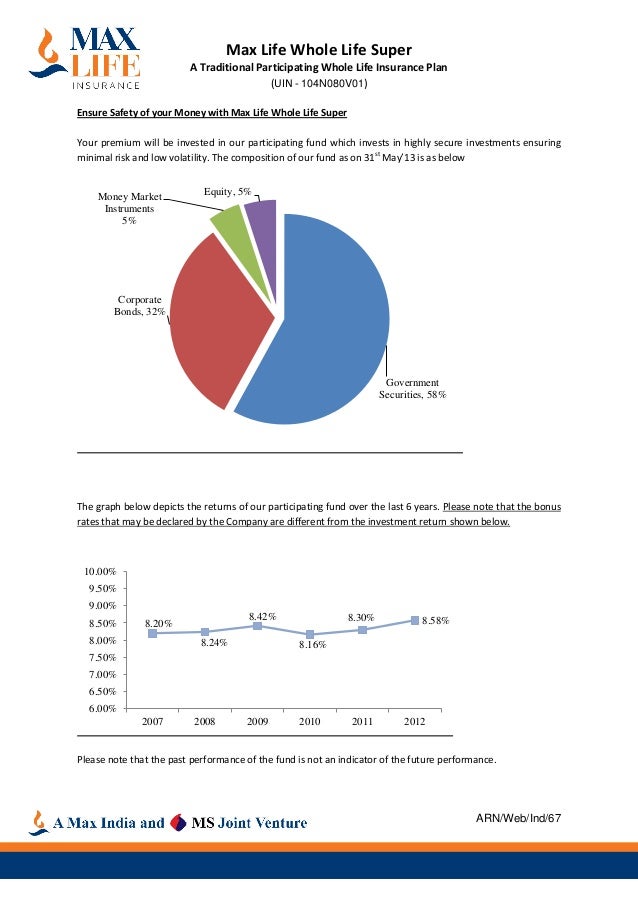

Whole Life Participating Insurance - Max Life Insurance

A Beginner's Guide To Participating Whole Life Insurance VS Investment

Whole Life Participating Insurance - Max Life Insurance

Use Participating Whole Life Insurance to benefit YOU! - Levine

Whole life insurance dividend rate of return history

Participating Whole Life Insurance - Whole Vs Term Life

Whole Life Participating Insurance - Max Life Insurance

Take a closer look at participating whole life insurance | Advisor's Edge

Post a Comment for "Participating Whole Life Insurance"