Whole Life Insurance Policy Cash Value

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Types of cash value life insurance whole life insurance. Whole life insurance is a type of permanent life insurance that’s possibly the simplest cash value. Guaranteed issue life insurance. Guaranteed issue life insurance is a type of.

The death benefit is the amount the insurance company will pay your beneficiary if you die, (minus any outstanding loans). The whole life policy’s cash surrender value grows over time thanks to a. The cash value of the policy can also be used to buy a new vehicle without a loan, defray college expenses, or pay off costly credit card debt. A whole life insurance cash surrender value on a policy with a face value of $275,000 after 15 years might be as much as $21,000 depending on how well the investment fund has performed. The life insurance company will invest your premiums, enabling it to provide the policy cash values. The way cash values grow depends on the type of policy purchased. The policy owner can access the policy cash value through a loan or withdrawal, depending on the type of policy. If you take out a loan, the life insurance company will charge. The cash surrender value on a whole life insurance policy is the amount that is paid out if a policyholder terminates the policy.

How Whole Life Insurance Works – Bank On Yourself

Whole Life Long Term Cash Value • The Insurance Pro Blog

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Whole Life Long Term Cash Value • The Insurance Pro Blog

Whole Life Long Term Cash Value • The Insurance Pro Blog

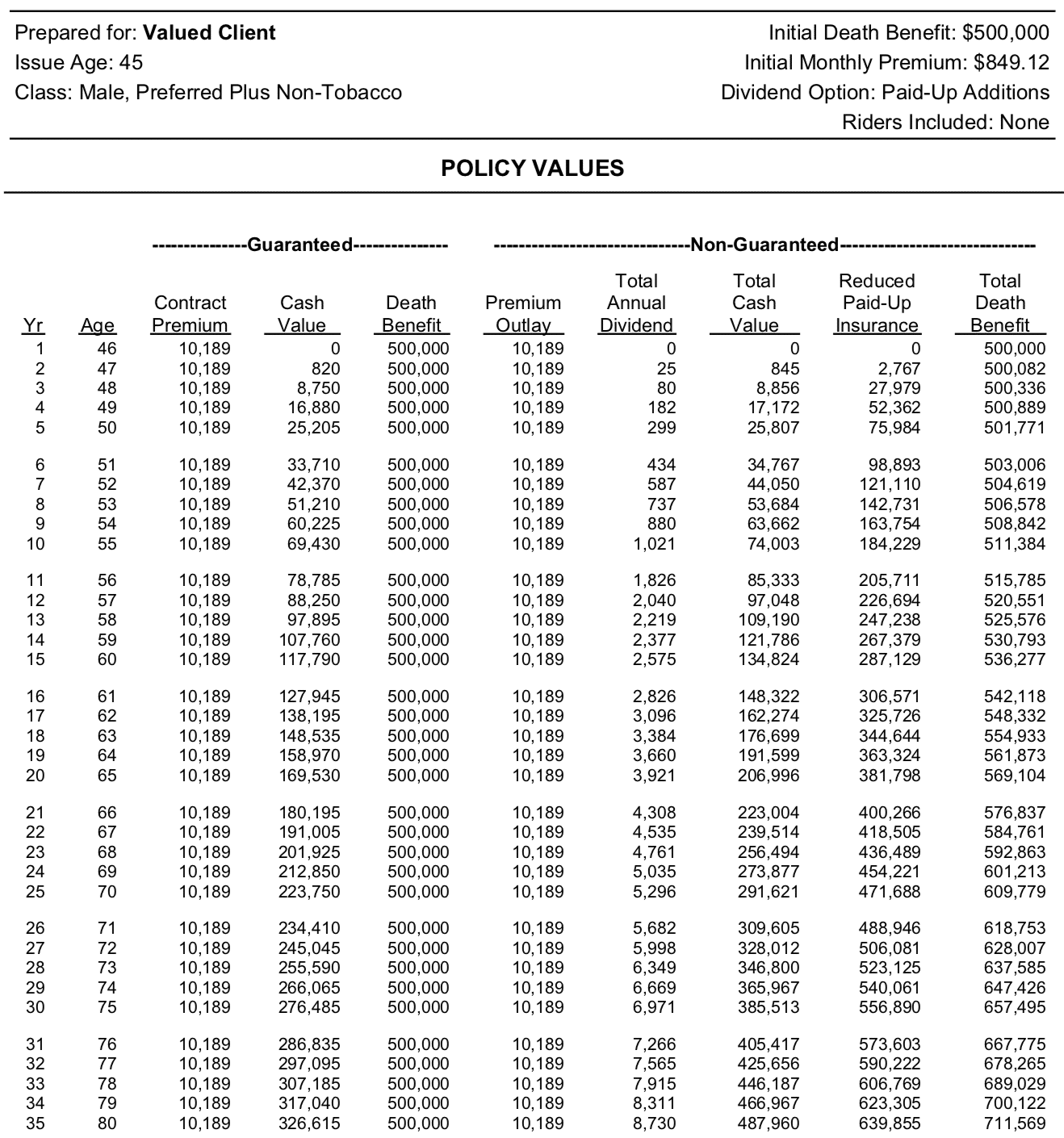

Understanding Whole Life Insurance Quotes & Illustrations - Top Quote

Best Dividend Paying Whole Life Insurance for Cash Value & Why

How Long Does It Take For Whole Life Insurance To Build Cash Value

Should You Get A Whole Life Insurance Policy? We Explain In Details How

Whole Life Long Term Cash Value • The Insurance Pro Blog

Post a Comment for "Whole Life Insurance Policy Cash Value"