State Farm Whole Life Insurance Cash Out

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

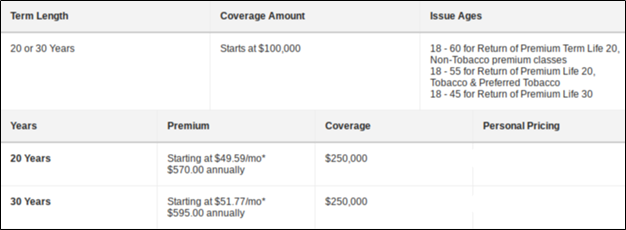

Select term $250,000 /30 yrs, $20. 23 per month. Return of premium $250,000 /30 yrs, $40. 25 per month. Limited pay $100,000 /15 yrs, $112. 58 per month. Single premium $100,000 of coverage, $19,799 /pay once.

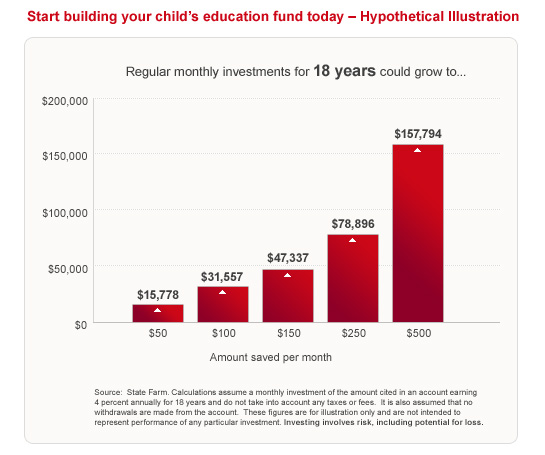

4. 2 out of 5. There are other companies with high ratings across the board, but state farm is not outperformed by many. State farm is currently number 42 in the fortune 500 list: State farm fortune 500. Whole life insurance policies can be partially or completely cashed out. This is a distinct advantage that whole life policies have over term life policies. The fact is that term life policies pay out only if the insured party dies. A whole life insurance policy is almost like having a savings account to use when you need it; Generally, you can withdraw a limited amount of cash from your whole life insurance policy.

State Farm Life Insurance Review: Quality Service and Policies Backed

state farm 10 pay

State Farm Life Insurance Review: Quality Service and Policies Backed

State Farm Life Insurance Calculator - Farm Tractors

State Farm Life Insurance Review

State Farm Life Insurance Reviews | Retirement Living

Does State Farm Have Life Insurance / State Farm Pet Insurance

State Farm Announces $2.2 billion in Auto Rate Cuts

The Best Life Insurance for 2018 | Reviews.com

Double the Donations With Jimmy Fallon! | State Farm

Post a Comment for "State Farm Whole Life Insurance Cash Out"