Guaranteed Whole Life Insurance For Seniors

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

The company is in business since 1845, so, no doubt about their stability. Besides, am best rated the company as a++. The most interesting thing about the company is they offer a whole life policy that is customizable. Guaranteed issue whole life insurance** is often referred to as senior life insurance or life insurance for the elderly.

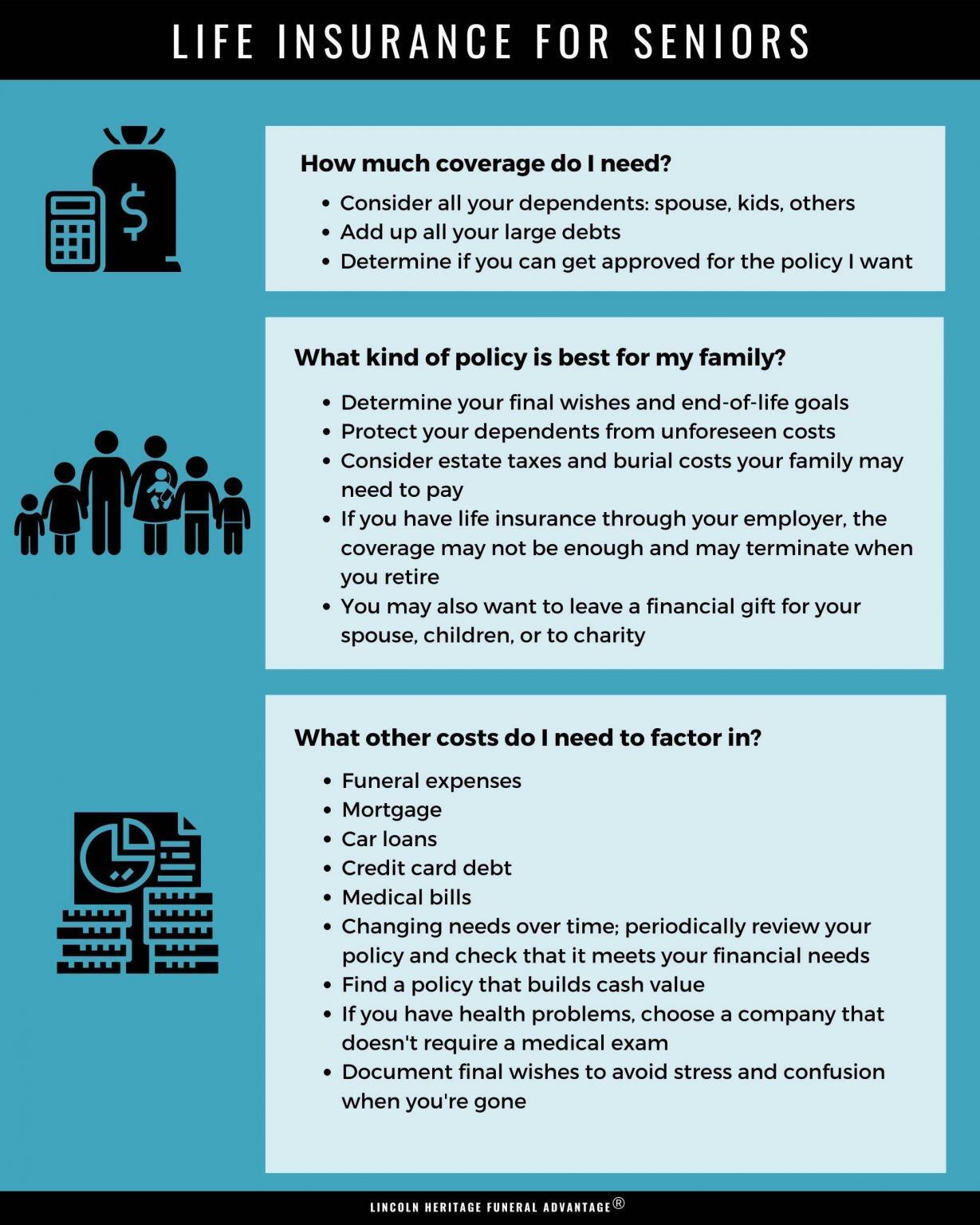

Guaranteed universal life insurance is a great option for seniors because of all the benefits that come with this option. The ability to find a middle ground between the pricey whole life insurance and the restrictions that come with term life policies is perfect. Aaa guaranteed issue life insurance is a whole life policy with no health questionnaire. Guaranteed acceptance is the best type of life insurance for seniors when you have uninsurable medical conditions such as alzheimer’s, renal failure, or congestive heart failure, to. While some companies do provide senior whole life insurance (or burial insurance or final expense insurance) for certain individuals who are younger than 50 or older than 85, the majority of senior whole life. One of these is final expenditure insurance. This policy has a lower benefit than other policies, but it can help pay for important needs like funeral bills. Whole life insurance policies are one type of policy that can be beneficial for seniors. Survivorship whole life insurance policies are designed for couples aged 60 and up.

I Want Life Insurance: Guaranteed Whole Life Insurance For Seniors

Whole Life Insurance Quotes For Seniors - nolyutesa

I Want Life Insurance: Guaranteed Whole Life Insurance For Seniors

Whole Life Insurance Quotes For Seniors - nolyutesa

No Exam, Guaranteed Issue Whole Life Insurance for Seniors - YouTube

Best Life Insurance for Seniors (Term vs Whole, Affordable, No Exam)

Boise Life Insurance - Seniors Life Insurance Policies - Sample Quote

Whole Life Insurance For Seniors No Medical Exam - Insurance Reference

Life Insurance For Seniors | Top 7 Mistakes To Avoid + Rates + FAQs

Insider Secrets To Guaranteed Issue Life Insurance [Best Companies]

![Guaranteed Whole Life Insurance For Seniors Insider Secrets To Guaranteed Issue Life Insurance [Best Companies]](https://choicemutual.com/wp-content/uploads/2017/05/guaranteedissuelifeinsurance.jpg)

Post a Comment for "Guaranteed Whole Life Insurance For Seniors"