Whole Life Policy Cash Value

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Cash value whole life is a form of permanent life insurance coverage. The cash surrender value on a whole life insurance policy is the amount that is paid out if a policyholder terminates the policy. This is typically the cash value with any outstanding loans. The life insurance company will invest your premiums, enabling it to provide the policy cash values.

First, this is a deep dive into whole life cash value, but we don’t want you to waste your time. You can skip ahead or read all the details in our review. Here are our ratings for the. Cash value grows at a fixed rate for traditional whole life insurance. Say you have a whole life insurance policy with a cash value of $15,000. You’ve paid a total of $10,000 in premiums. That means you could be taxed on the additional $5,000. 7 rowsuniversal life policies accumulate cash value based on current interest rates. The accumulation of cash value is the major differentiator between whole life and term life insurance.

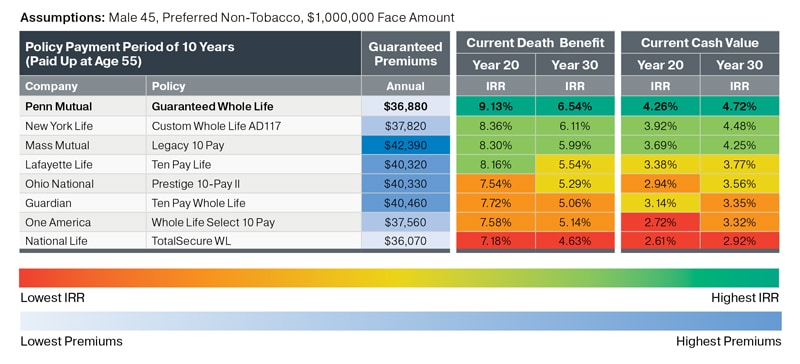

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Whole Life Long Term Cash Value • The Insurance Pro Blog

Whole Life Long Term Cash Value • The Insurance Pro Blog

Whole Life Long Term Cash Value • The Insurance Pro Blog

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Whole Life Long Term Cash Value • The Insurance Pro Blog

Pin on Whole Life insurance

How Whole Life Insurance Works – Bank On Yourself

Whole Life Insurance Calculator Cash Value

Explaining the Cash Value of Whole Life Insurance - Sproutt life insurance

Post a Comment for "Whole Life Policy Cash Value"