Whole Life Insurance For Seniors Over 60

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Factors scored were to determine the best senior life insurance were: Cost competitiveness (30% of score): This measures the level of premiums and internal policy charges, including the cost of. Life insurance for 60 year old man vs.

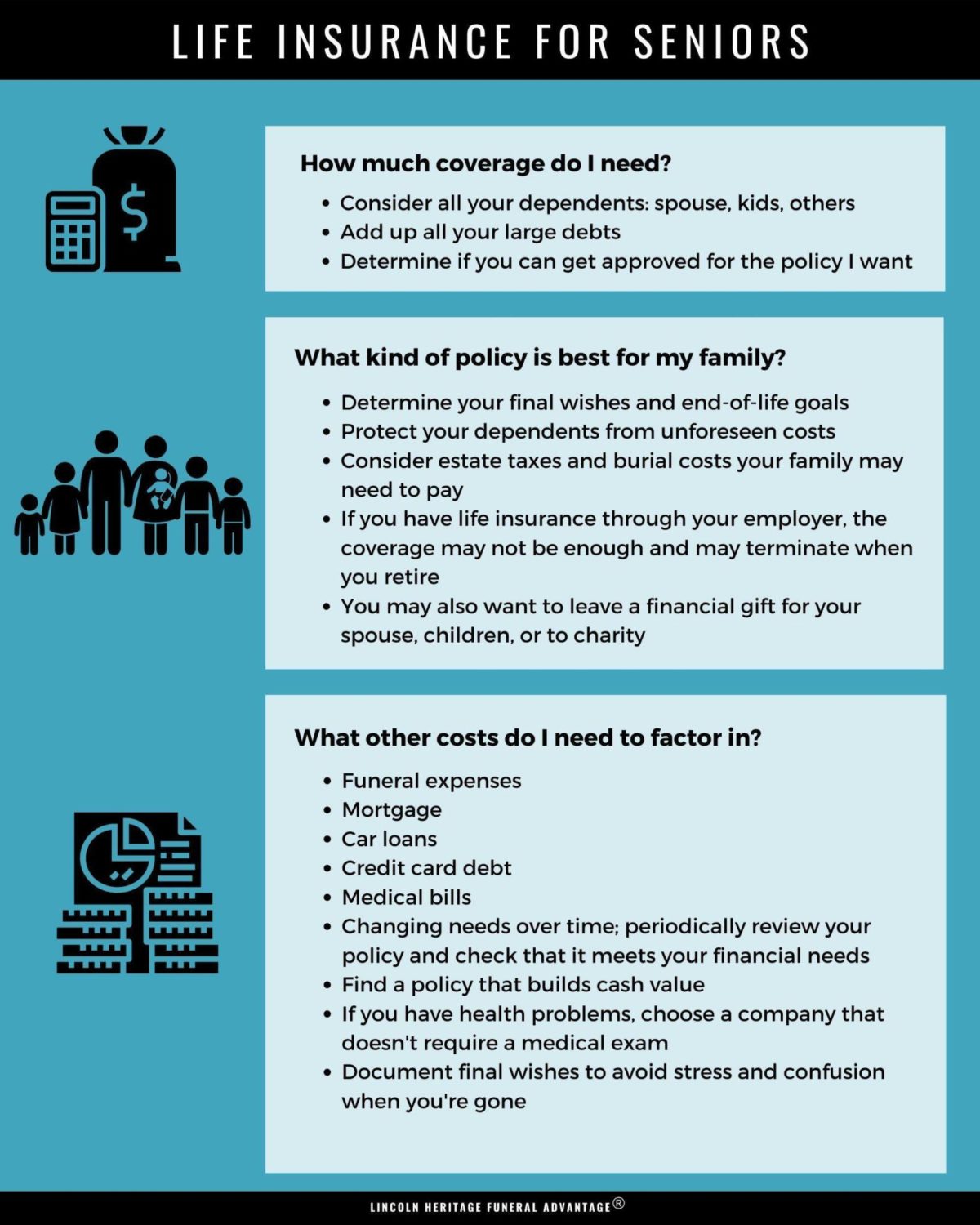

Although it’s more expensive than other types of policies, there are affordable whole life insurance plans for those 60 and older. Average annual whole life insurance rates for men* age. 60$250,000$9,11160$500,000$18,16460$1,000,000$35,807 * estimated rates do not reflect the rates of any particular life insurance. 4. 5/5 (69 votes). At age 50 or older, term life will generally be the most affordable option for getting the death benefit needed to help ensure your family is provided for. Coverage for final expenses. A cheap term life insurance policy to consider for those over 60 years old is the protective classic choice product. This insurance plan is guaranteed level throughout the coverage period, which means that you pay the same premium until the policy ends. The death benefit has a minimum coverage amount of $100,000 and a maximum of $50 million.

Whole Life Insurance Quotes For Seniors - nolyutesa

Get Affordable Life Insurance for Seniors Over 60 - Perfect Financial Plan

Life Insurance For Over 60 Years Old | 30 Year Term Policies for Seniors

Best Life Insurance for Seniors in 2020 | Best Companies & Policy Types

The Best Life Insurance For Seniors - Insurance Reference

Thinking of Buying Life Insurance as a Senior? Read This | Life

Whole Life Insurance Quotes For Seniors - nolyutesa

Best Life Insurance for Seniors Over 60 (Affordable, Whole, Term)

Best Life Insurance for Seniors (Term vs Whole, Affordable, No Exam)

Pin on Burial Insurance For Seniors

Post a Comment for "Whole Life Insurance For Seniors Over 60"