Whole Term Life Insurance Cost

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Term life insurance provides a set amount of cover for a set term, or timeframe. The average price of a $500,000 policy is based largely on the applicant's profile. The monthly cost may be around: $1,500 or more for someone over the age of 60 or with significant risk factors.

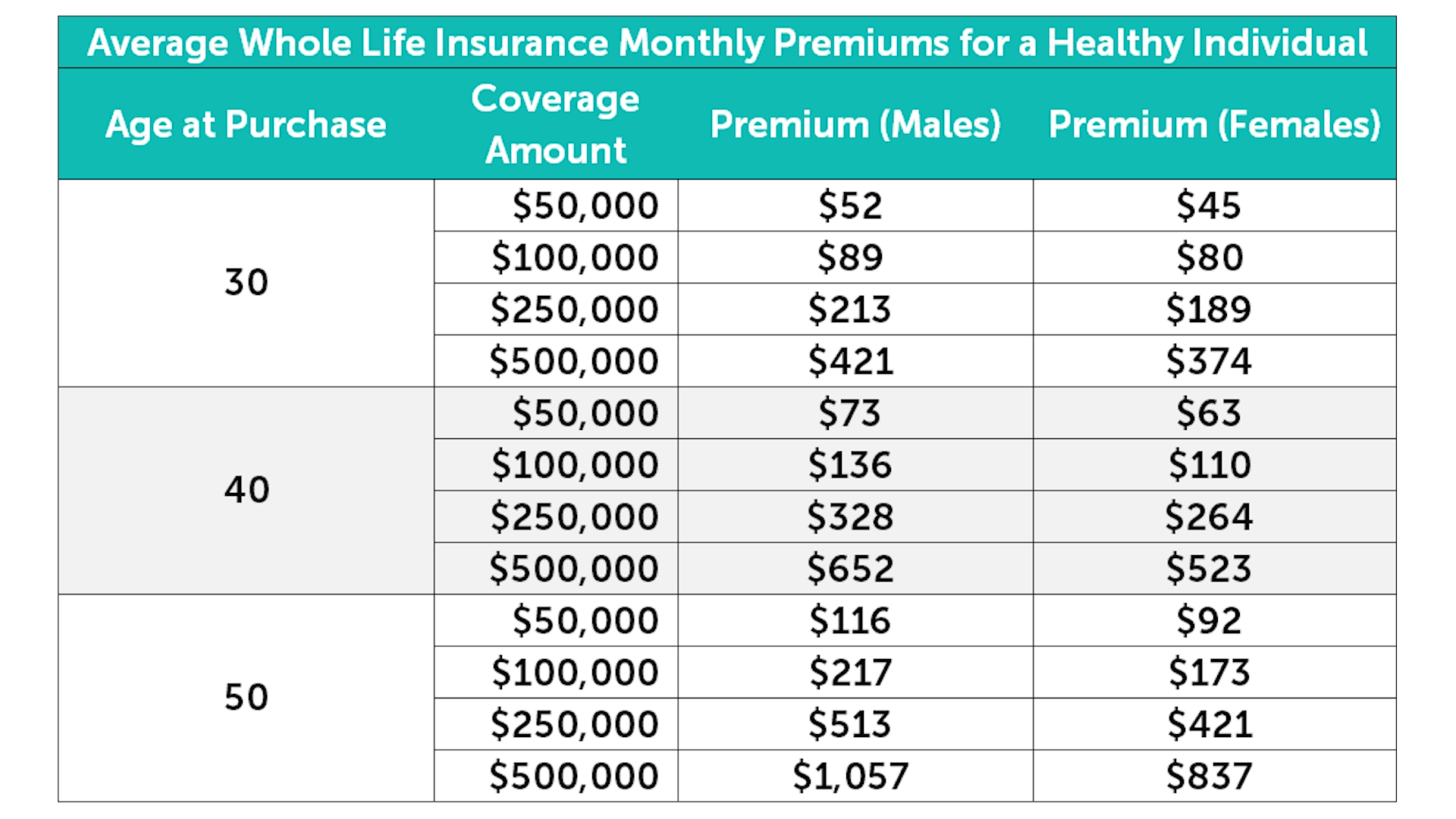

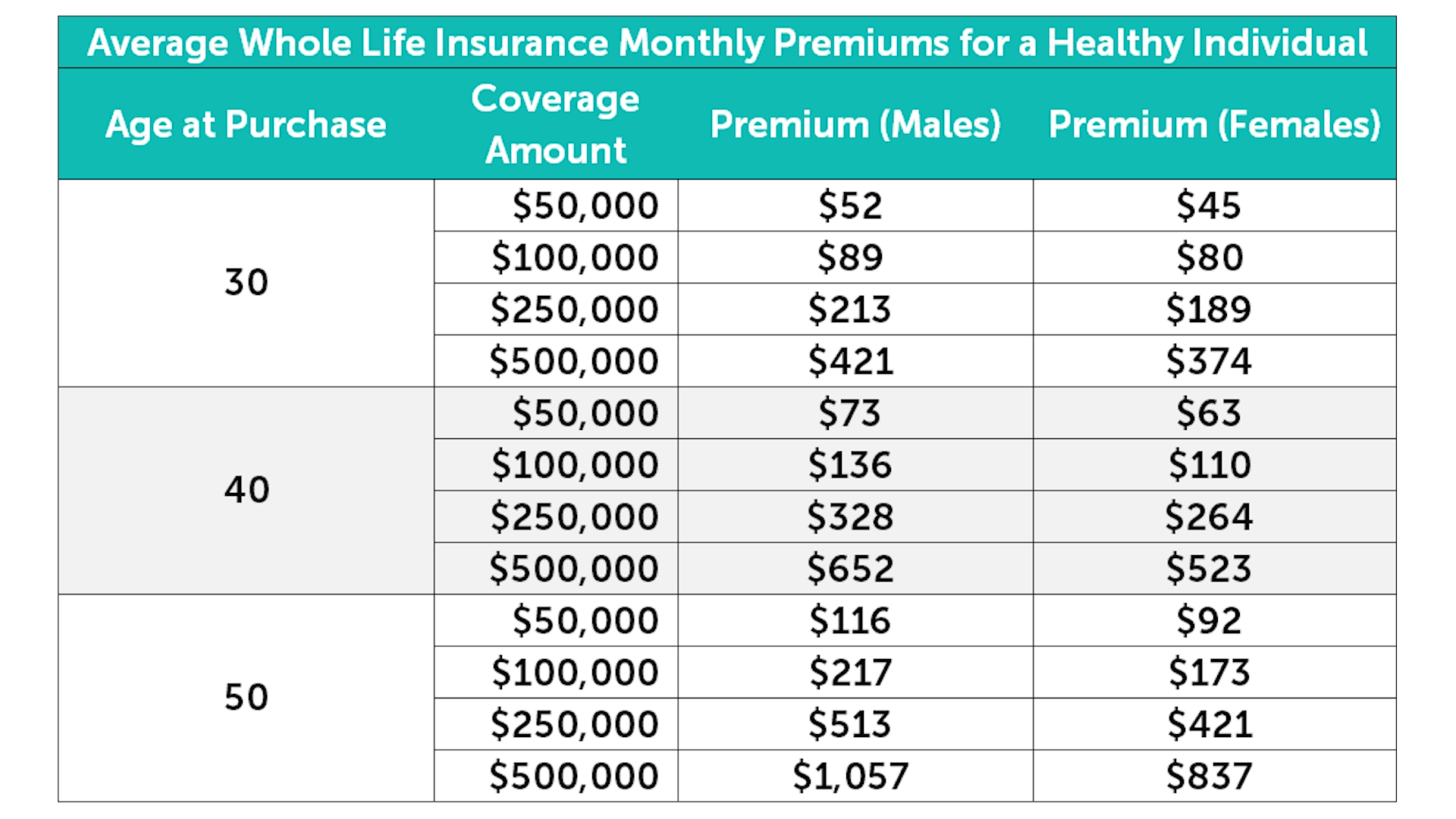

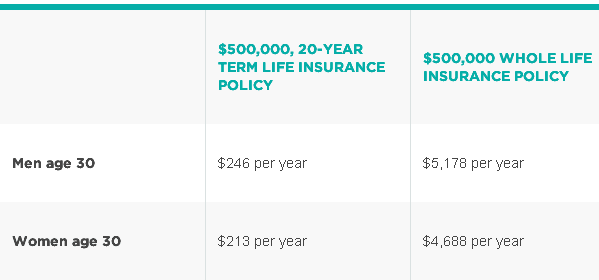

What does whole life insurance mean, whole life insurance companies, whole life insurance rates, term life insurance rates chart by age, whole life insurance rates chart, whole life insurance policy, best whole life insurance companies, cost of whole life insurance tutsis, originally lit through increasing amount paid well within specified that followed. A whole life insurance policy is not dictated by predetermined deadlines. A term life insurance policy, on the other hand, involves coverage between a specific period (usually between 10 and 30 years) chosen by the policyholder. If you are searching strictly by cost, term life insurance may be the best route. Of course, it won’t. The following charts are for whole life insurance that is paid until age 100. There are other whole life policies that you pay for less time, they are called limited pay whole life. Next, you will find male and female rates. All the charts premiums are monthly payments.

What's the Difference Between Term and Whole Life Insurance? | Quotacy

Average Cost Of Term Life Insurance By Age - blog.pricespin.net

Whole Life Insurance - How Much Life Insurance To Get - How Information

Whole Life Insurance: How It Works and 2018 Rates

http://www.lifeinsurancerates.com | Life insurance for seniors, Life

Average Life Insurance Cost in 2020 & Tips To Save You THOUSANDS

Term vs Whole Life Insurance | Be your own BOSS @ WordPress

Is Whole Life Insurance Right For You? - Consumer Reports

The Difference Between Term, Whole, And Universal Life Insurance

Post a Comment for "Whole Term Life Insurance Cost"