A Whole Life Insurance Policy Accumulates Cash Value That Becomes

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

The right to return the policy for a full refund within a specified number of days. A whole life insurance policy. A whole life insurance policy accumulates cash value that becomes. A) the policy loan value which the insured may borrow against b) the death benefit c) the source of funding for.

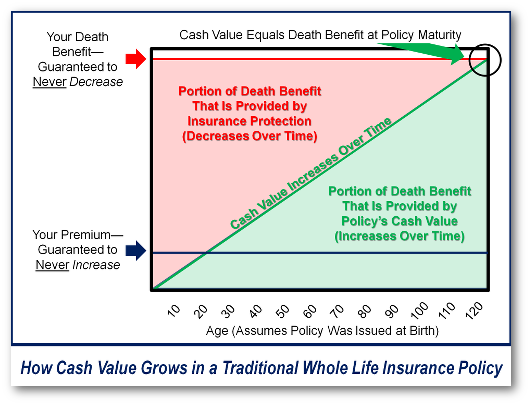

Cash value for these types of policies accumulates until age 100 and the face value. The cash value of whole life. Cash value grows at a fixed rate for traditional whole life insurance. Traditional whole life insurance policies offer coverage with level premiums paid up to a certain age. How is cash value in whole life policy different from cash value in indexed or variable universal life policy? How cash value account is built up is the unique differentiator. A life insurance policy which contains cash values that vary according to its investment performance of stocks is called. In this situation, the death benefit would be the. A whole life insurance policy accumulates cash value that becomes the policy loan value which the insured may borrow against the death benefit the source of funding for administration.

Life Insurance In Depth — Custom Wealth Management

The Term Rut - Hurlberton

How Long Does It Take For Whole Life Insurance To Build Cash Value

Whole Life Insurance Reddit / Cash Value Life Insurance--Reddit Style

Can You Cash Out A Life Insurance Policy

How Cash Value Builds in a Life Insurance Policy | Investopedia

How to get cash value of life insurance | COOKING WITH THE PROS

5 Things to Know About Whole Life Insurance Before Buying

Life Insurance Policy - Life Insurance Policy Stock Photo - Image

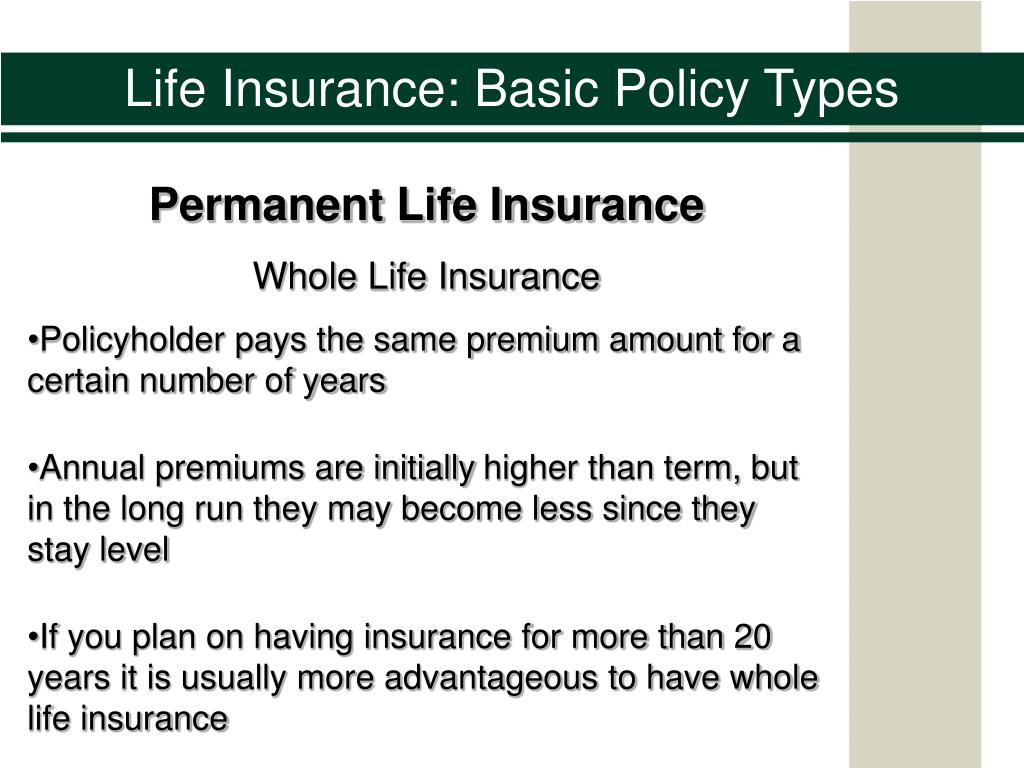

PPT - Life Insurance: Basic Policy Types PowerPoint Presentation, free

Post a Comment for "A Whole Life Insurance Policy Accumulates Cash Value That Becomes"