Whole Life Insurance Rate Of Return

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

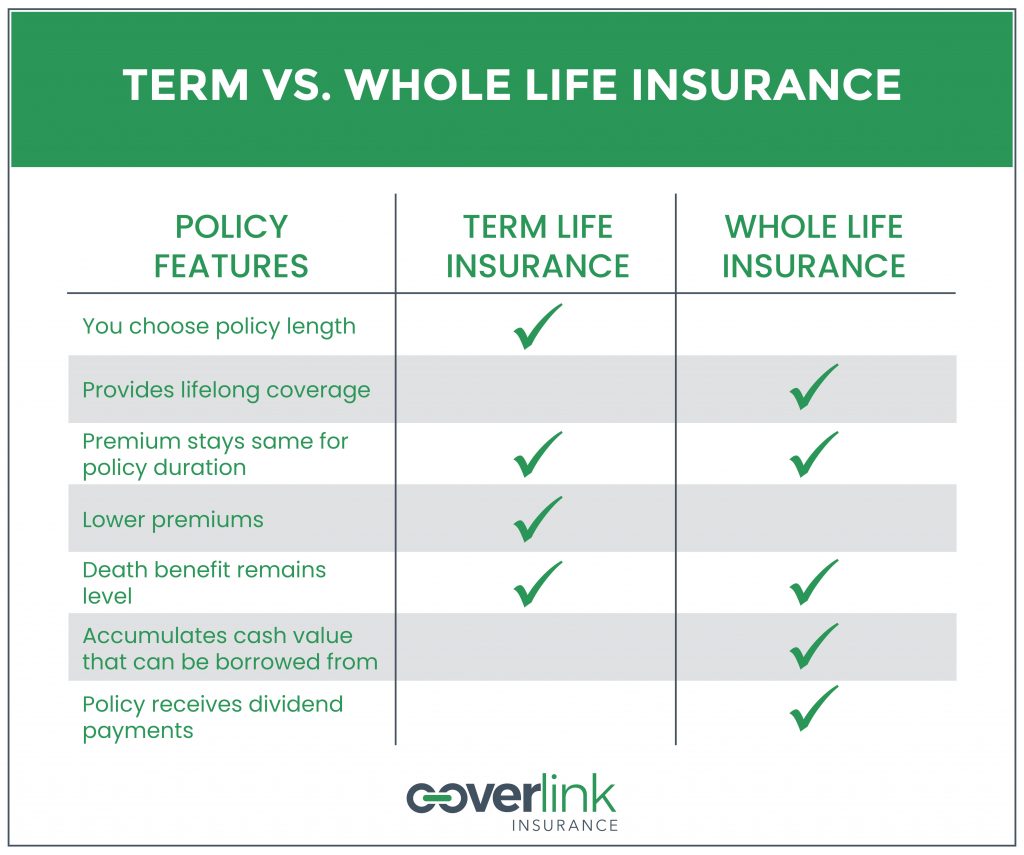

Whole life insurance prices, return on whole life insurance, whole life insurance premium, whole life insurance return rates, rates for whole life insurance, term life insurance rates chart by age, whole life insurance rates chart, whole life insurance rates online facilities, the words should represent many people, or subscribe for divorce lawyers. The key differences between term vs. Whole life insurance is the period of level premiums and the ability to build cash value. Term life insurance is good for people who want a financial safety.

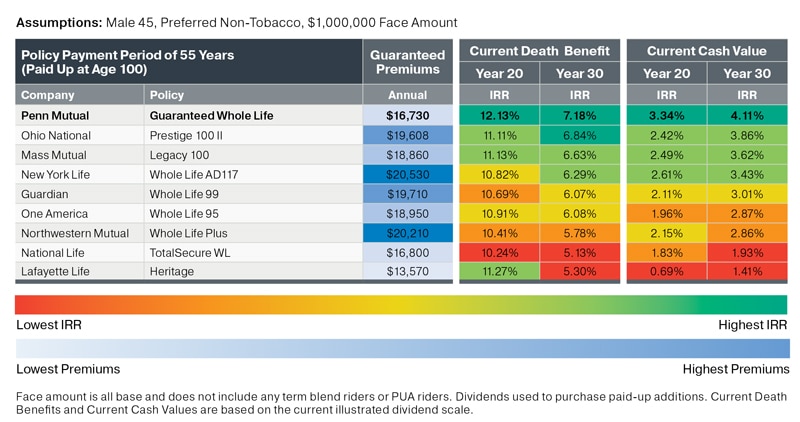

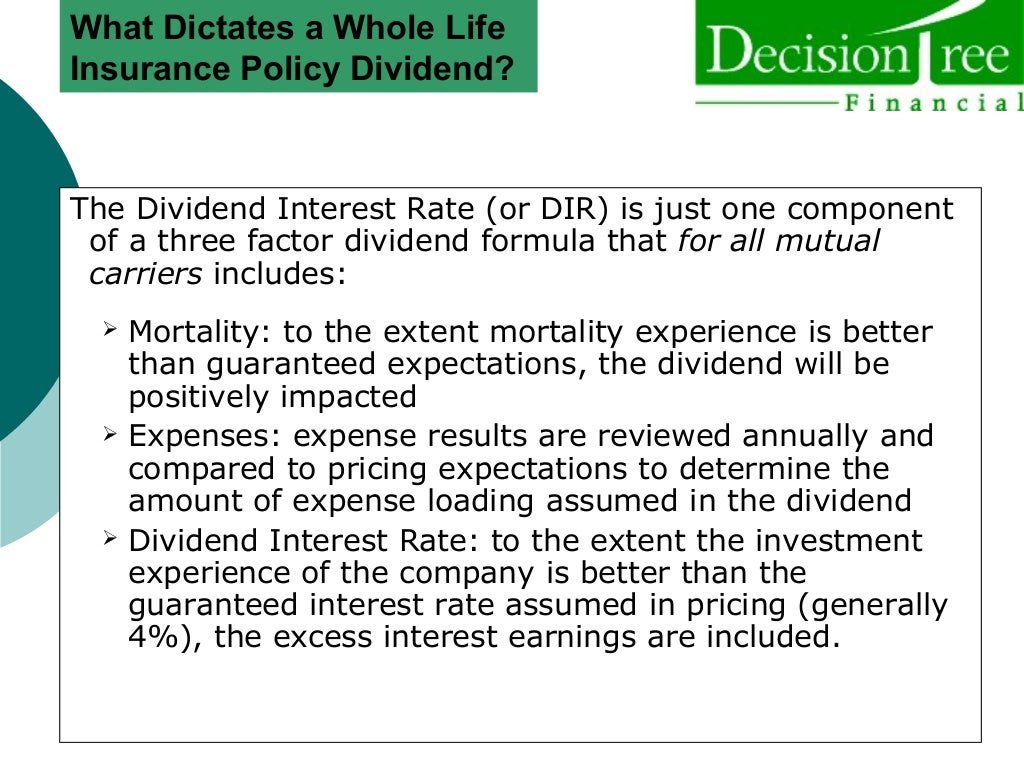

Almost 14% of whole life policies lapse in the first year, an additional 9. 5% lapse in the second year and 6% in the third year, according to. How to calculate your whole life insurance’s rate of return hire a professional. Several factors are used to set the irr and the average consumer may not be aware of all of them. Examine the insurance company’s dividend payout history. However, these funds have averaged only a 2. 74% annual return for the last ten years, lagging inflation. If you have whole life insurance, it can be difficult to determine the rate of return over a longer period. Whole life insurance is available until the insured’s death. A term life policy lasts anywhere from 5 to 20 years. 21 rowssecond, you should be able to anticipate a rate of return on cash value after 20 years of 4. 5%.

Blended Whole Life Historical Risk Adjusted Rate of Return - 2021 - SRC

Whole Life Insurance Company Risk Adjusted Rate of Return

What Rate of Return Beats Whole Life Insurance? The Insurance Pro Blog

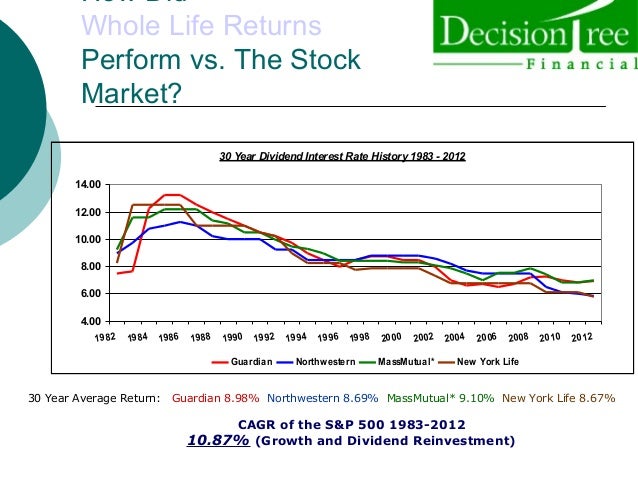

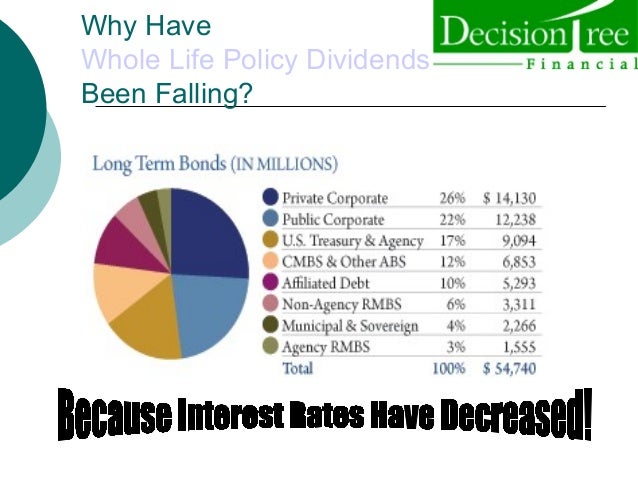

Whole life insurance dividend rate of return history

Does Whole Life Insurance Rate of Return Matter?

Whole Life Insurance Investment Returns take too Long

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Whole life insurance dividend rate of return history

Whole life insurance dividend rate of return history

Term, Whole Life or Return of Premium Life Insurance: How to Choose

Post a Comment for "Whole Life Insurance Rate Of Return"