Cashing In Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Chris kirkpatrick from life180 shares his cashflow hacking strategy to maximize and control the benefits of your properly structured whole life insurance pol. If you cash in a whole life insurance policy, you will. The cash value of a whole life insurance policy is taxable in certain events, such as when using the policy as collateral for a loan or if the policy is surrendered. Once you have come to a decision to cash in your policy, the process is easy.

If not, you can request. Most whole life policies endow at age 100. When a policyholder outlives the policy, the insurance company may pay the full cash value to the policyholder (which in this case equals. 2 disadvantages of cashing in your life insurance policy. 2. 1 you may be endangering your family’s future. 2. 2 you’ll likely pay more in premiums should you decide to. Comprehensive guide to whole life insurance. With a death benefit and cash value that grows over time, whole life insurance protects you and your family for life. Tax implications of cashing out whole life insurance policy.

Explaining the Cash Value of Whole Life Insurance - Sproutt life insurance

Can You Cash In Your Whole Life Insurance Policy : Your Financial

How Whole Life Insurance Works – Bank On Yourself

How Does Whole Life Insurance Work As An Investment

Can I cash in my whole life insurance policy? | Compare Life Insurance

EP182: How to Use Cash Value Whole Life Insurance to Buy Real Estate in

Whole Life insurance for Diabetics - 2020 Best Companies, Rates, & Tips

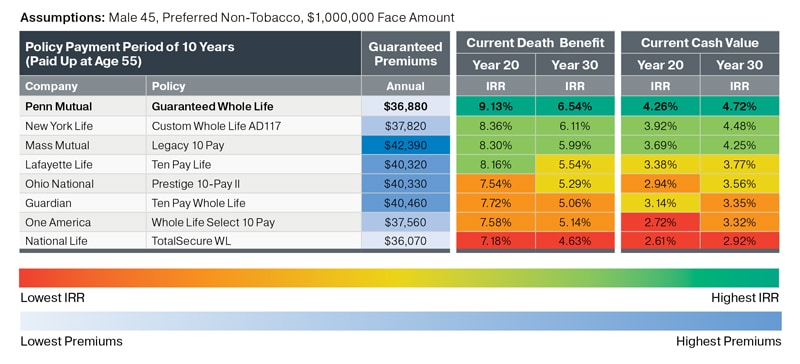

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Cash Value in Life Insurance - What is it?

Whole Life Insurance Cash Value Farmers Essentiallife® Simple Whole

Post a Comment for "Cashing In Whole Life Insurance"