Whole Life Insurance Coverage

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

It and universal life insurance are the two most commonly sold types of life insurance policies on the market. A “standard” whole life policy requires premium payments for the life of the policy for a dollar amount of coverage—the death benefit—that’s determined when the policy is issued. Since this structure can be unnecessarily. Whole life insurance for immediate protection that lasts a lifetime.

Low face amounts provide just the right amount of coverage for seniors in particular. A nonforfeiture option for a whole life insurance policy takes effect if you decide to stop paying your premiums. In this situation, you'll have several paths to access the guaranteed cash value of this type of policy: Request the cash surrender value of the policy and end your coverage. You'll get the amount, which is the savings aspect of. Liberty mutual insurance company is an insurance company which offers coverage for individuals, families, and businesses. Car insurance, homeowner insurance, renters insurance, fraud protection, life insurance, pet insurance, accident insurance, mobile phone insurance and so on. With whole life insurance, you pay the same consistent, guaranteed premiums and when you pass away, your beneficiaries will receive a predetermined death benefit. When you pay your premiums for your whole life insurance policy, part of that money is used to cover the cost to insure you.

SG Budget Babe: Should I buy Term or Whole Life Insurance?

Is Whole Life Insurance a Good Investment? • The Insurance Pro Blog

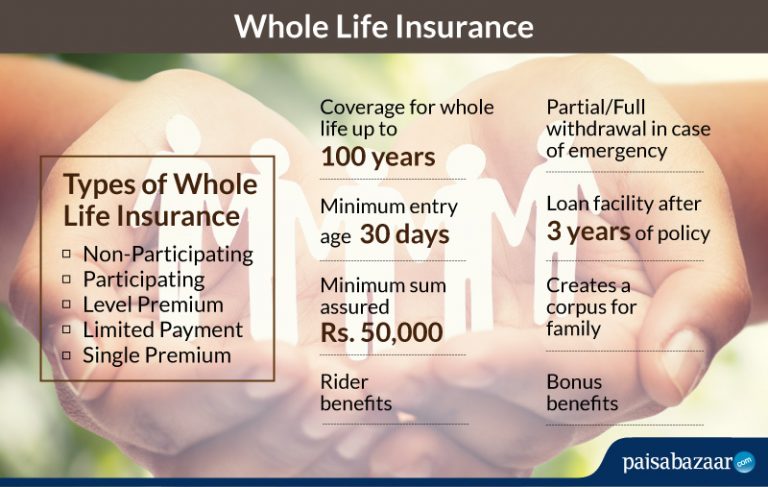

Features & Benefits of Permanent Whole Life Insurance - Paisabazaar.com

Life Insurance Types Explained [Term Life, Whole Life, Universal Life]

![Whole Life Insurance Coverage Life Insurance Types Explained [Term Life, Whole Life, Universal Life]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Whole-Life-Insurance-Key-Factors.png)

Whole Life Insurance: Check & Compare Whole Life Insurance Online

Why You Should Not Expect Returns From Life Insurance Policies

Whole Life Insurance - Guaranteed death benefit and premiums

What are the Benefits of Whole Life Insurance Coverage - Top Insurance

How Does Whole Life Insurance Policy Work

Best Whole Life Insurance Companies / Whole Life Insurance Rates By Age

Post a Comment for "Whole Life Insurance Coverage"