Straight Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholder's life and has a savings component. It pays out a death benefit upon the policyholder's death, and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against. It contrasts with term life. Straight life insurance is a type of permanent life insurance.

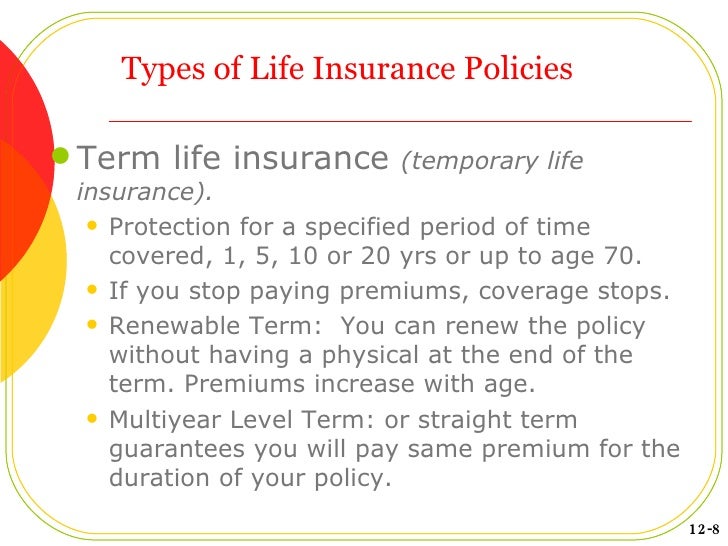

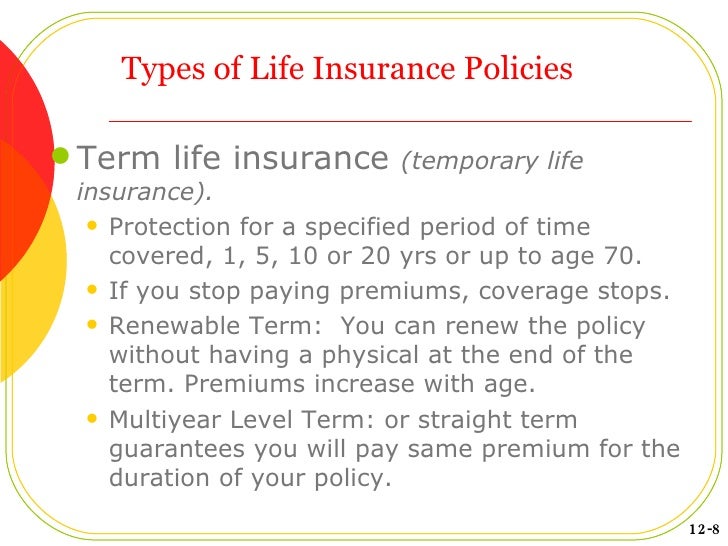

It is also known as ordinary life insurance or whole life insurance. Such type of insurance helps your family prepare for the sudden. The guaranteed death benefit can help replace a family's. Whole life insurance is a type of permanent life insurance that covers the insured throughout the entire duration of their life and upon passing of the insured, the whole life insurance policy will pay the death benefit to the beneficiaries. In addition to the insurance component, whole life insurance has an investment part, allowing the. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. As a life insurance policy it represents a contract between the insured and insurer that as long. Straight life and whole life are the same. There are two main types of life insurance:

What Is An Irrevocable Life Insurance Trust: Straight Life Insurance Policy

Is a Straight Life Policy Right for Me? - Paradigmlife.net Blog

What Is An Irrevocable Life Insurance Trust: Straight Life Insurance Policy

Whole Life Insurance The Purpose Of Whole Life Insurance Is To Provide

Whole life insurance

Straight Whole Life – Premium Life Insurance

PPT - The Work of an Actuary: Mortality Tables and Life Insurance

Is Permanent And Whole Life Insurance The Same - Dave Ramsey's unjust

Whole Life Insurance

A Simple Guide To Whole Life Insurance

Post a Comment for "Straight Whole Life Insurance"