Whole Term Life Insurance Policy

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Whole of life insurance (also known as whole life assurance) is a policy that covers you for life. Because there’s no fixed term, your insurance will never expire until you die. If you've decided that getting life insurance makes financial sense, you may now be wondering about the difference between a term life policy and a whole life policy. the main differences between whole life insurance and term insurance are coverage length, cost and cash value. Term is pure life insurance, offering a death benefit for a set number of years and no.

The whole life insurance premiums stay the same for your entire lifetime, unlike term life premiums which increase upon renewal at the end of the initial term. The first difference between term and whole life insurance is in the definition. Term life plans expire, while whole life plans never do. Most term life plans last anywhere between 10 and 30 years, although everyday life offers plans that last for up to 40 years. If you have a term life plan and you are still alive at the end of the term, you. One of the biggest is cost. Whole life insurance policies are typically more expensive than term policies. In fact, whole life insurance can cost around six times as much as term insurance with the same death benefit. However, insurers consider several personal details that will affect your rates, regardless of the type of policy you choose.

SG Budget Babe: Should I buy Term or Whole Life Insurance?

Term Life vs. Whole Life Insurance: Which Is Best for You? - MediVac

Term vs Whole Life Insurance | Be your own BOSS @ WordPress

Term Life Insurance vs. Whole Life Insurance - Johnson & Associates

Life Insurance Types Explained [Term Life, Whole Life, Universal Life]

![Whole Term Life Insurance Policy Life Insurance Types Explained [Term Life, Whole Life, Universal Life]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Whole-Life-Insurance-Key-Factors.png)

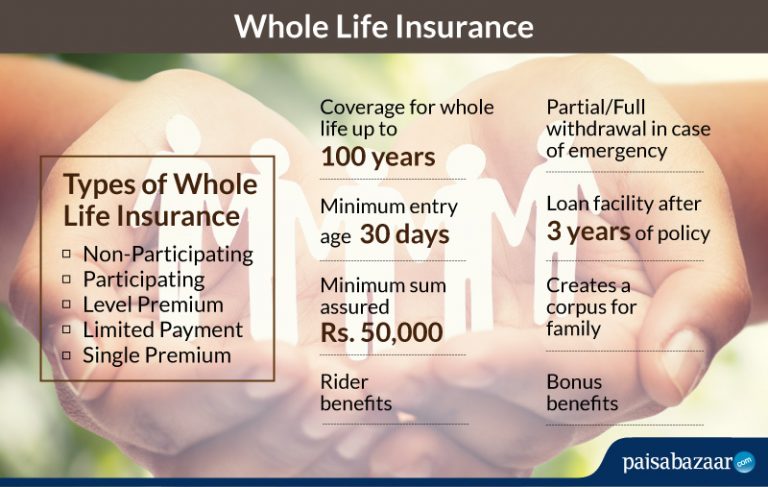

Features & Benefits of Permanent Whole Life Insurance - Paisabazaar.com

Articles Junction: Types of Life Insurance Policies Life Insurance

Level Term Life Insurance: What It Is and How It Works

Term Life Insurance Advantages and Disadvantages | Effortless Insurance

Whole Life Insurance: Check & Compare Whole Life Insurance Online

Post a Comment for "Whole Term Life Insurance Policy"