Whole Life Term Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Whole life insurance is the most common type of permanent life insurance and costs more than term life. This is because most policies offer coverage that’s designed to last a lifetime and pay. With term insurance, a death benefit is a primary feature. But whole life policies combine both a death benefit and a savings feature.

The downside is that at the end of the term, the policy will. Whole life or term life insurance? Know the differences between whole of life and term life. Print share key differences. Consider how the features match your objectives and budget, today and over time. Consider which benefits you value now and as. Whole life insurance is more expensive because it lasts for your whole life and has a cash value that earns a guaranteed return on cash value. Below are monthly price comparisons between term life and whole life insurance. The most common term length is 20 years;

Term vs Whole Life Insurance | Be your own BOSS @ WordPress

Term Life vs. Whole Life Insurance | DaveRamsey.com | Dave ramsey life

Term or whole life insurance - insurance

Level Term Life Insurance: What It Is and How It Works

Term Life vs. Whole Life Insurance: Which Is Best for You? - MediVac

Term Life vs. Whole Life Insurance | Differences Explained

Whole Life Term Life Insurance > BURSAHAGA.COM

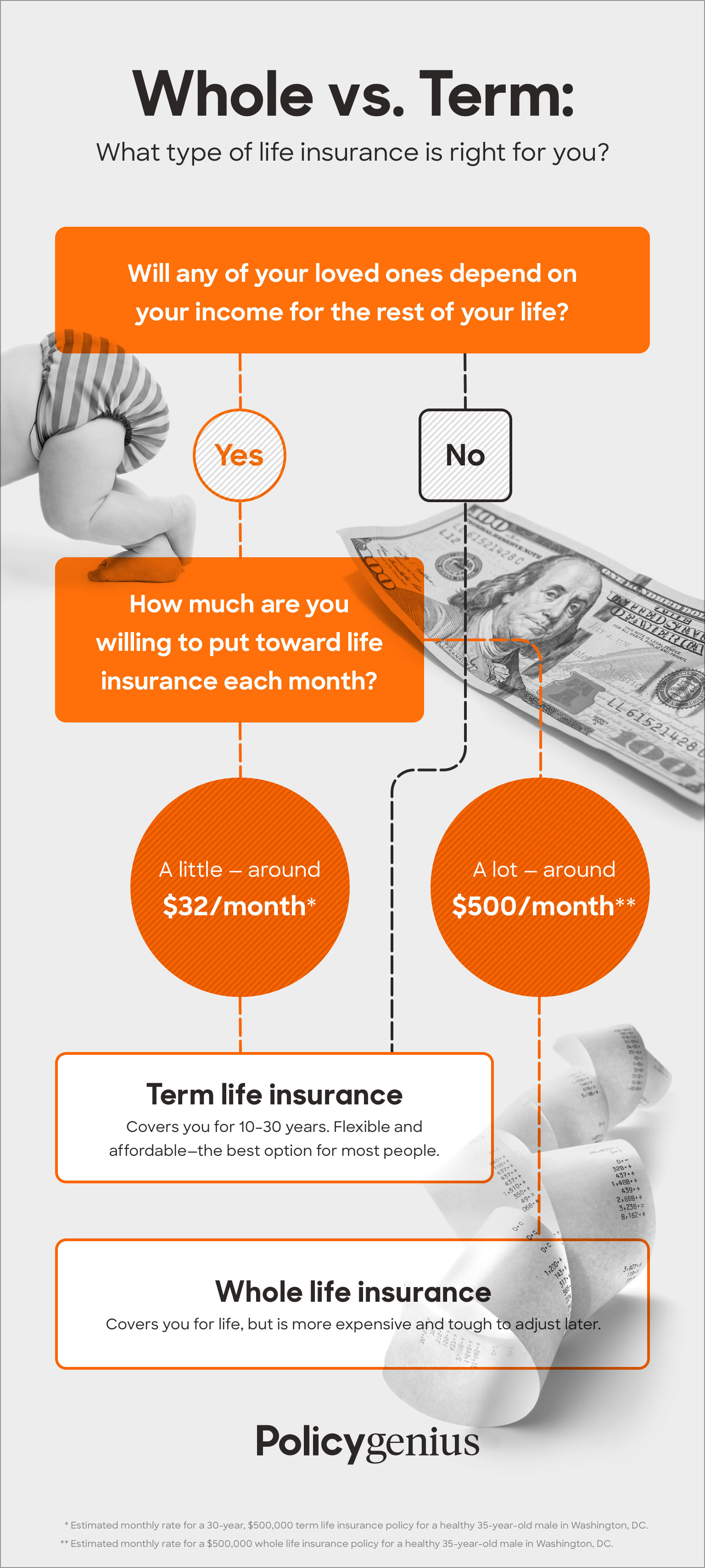

Term vs. Whole Life Insurance | Policygenius

Difference Between Term And Whole Life Insurance | Visual.ly

Infographic - Whole Life Insurance vs. Term Life Insurance | Symbo

Post a Comment for "Whole Life Term Life Insurance"