Single Premium Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Minimum face amount $15,000. One premium payment for a lifetime of benefits. Look into what single premium life insurance can offer. You make one single premium payment.

It was once a popular tax shelter. Single premium whole life insurance is unique because it is not a monthly premium which is paid, but a lump sum paid by the insured under the policy. This is a great solution for those who either have legacy needs or would just prefer to have their policy completely paid off quickly. This type of single premium whole life insurance is a very. One type of life insurance is a single premium whole life insurance. Next, we will go into detail about whole life insurance, single premium whole life insurance, and all of the other information that you need to know. Having these details will help you to make an informed decision about the types of life insurance you can get. Aarp’s level benefit term life insurance is available to aarp members ages 50 to 74 and lasts until age 80. You can get $10,000 to $150,000 in coverage ($100,000 in montana and new york) when.

Single Premium Whole Life Insurance by SJH Insurance Services, LLC in

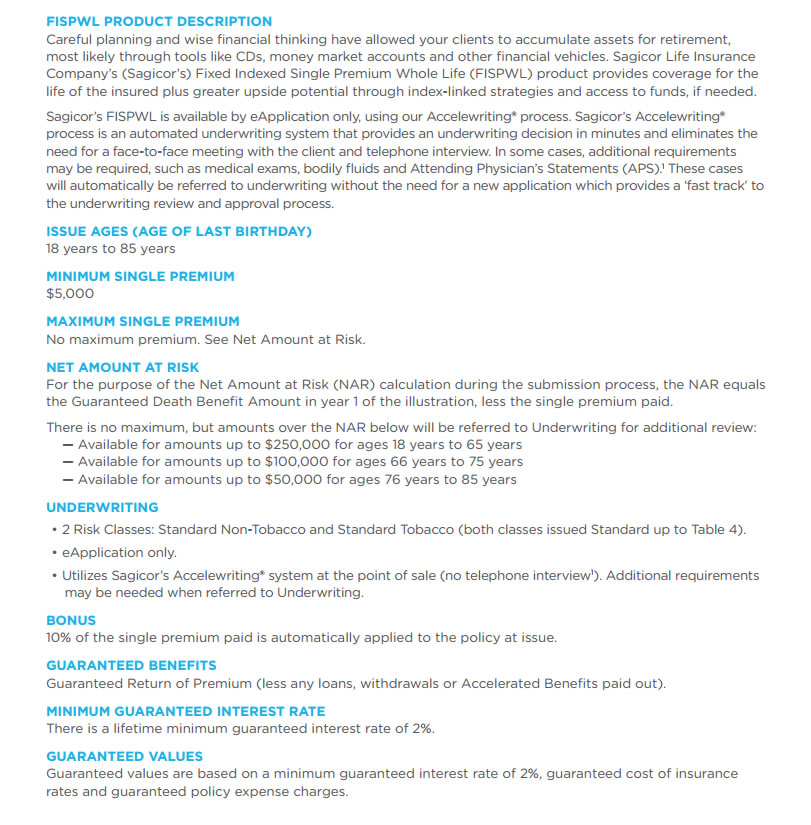

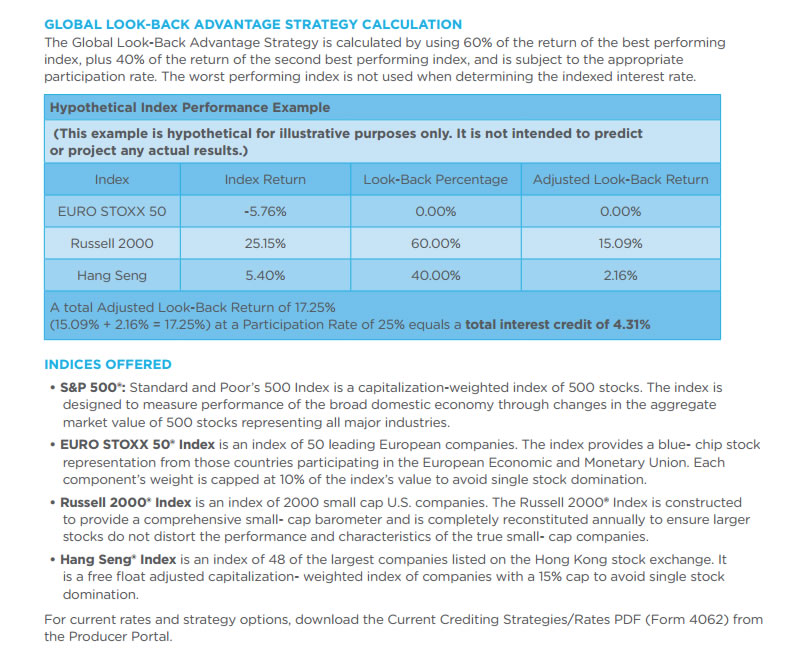

Sagicor Life Insurance Company - Fixed Indexed Single Premium Whole

Single Premium Life Insurance [The Top 7 Pros & Cons of SPL]

![Single Premium Whole Life Insurance Single Premium Life Insurance [The Top 7 Pros & Cons of SPL]](https://www.lifeinsuranceblog.net/wp-content/uploads/2019/02/Single-Premium-Life-Insurance.jpg)

Single Premium Life Insurance - Whole Vs Term Life

The Power of Single Premium Whole Life Insurance - YouTube

Sagicor Life Insurance Company - Fixed Indexed Single Premium Whole

Single Premium Whole Life Insurance- Reviews - YouTube

Pros of Single Premium Life Insurance - Yeager Insurance Blog

Sagicor Life Insurance Company - Fixed Indexed Single Premium Whole

Single Premium Life Insurance - Whole Vs Term Life

Post a Comment for "Single Premium Whole Life Insurance"