Whole Life Insurance Estimate

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

The story is similar for women. A $250,000 death benefit amount can be obtained for a $53 monthly premium as you start kindergarten. At 80 years old that number goes up to $1,632 per month! Hence, it is required by the insurer to do his/her homework and go through various insurance companies and their policies before choosing the right deal.

Life insurance premiums rise with an increase in the insurer’s age. Younger insurers have fewer premiums to pay. While all whole life policies offer a guaranteed death benefit and cash value growth, the amount of cash value you accumulate can vary depending on the policy you choose. Cash value can be as important as the death benefit. Monthly rates are for informational purposes only and must be qualified for. Whole life insurance policies are comprised of a death benefit and a cash value component. The payout upon the insured’s death, commonly called the death benefit, is usually also a constant figure. You can quickly get a solid estimate of what a whole life insurance policy would cost you per month. In order to receive an insurance quote.

What Happens to Your Life Insurance When You Retire?

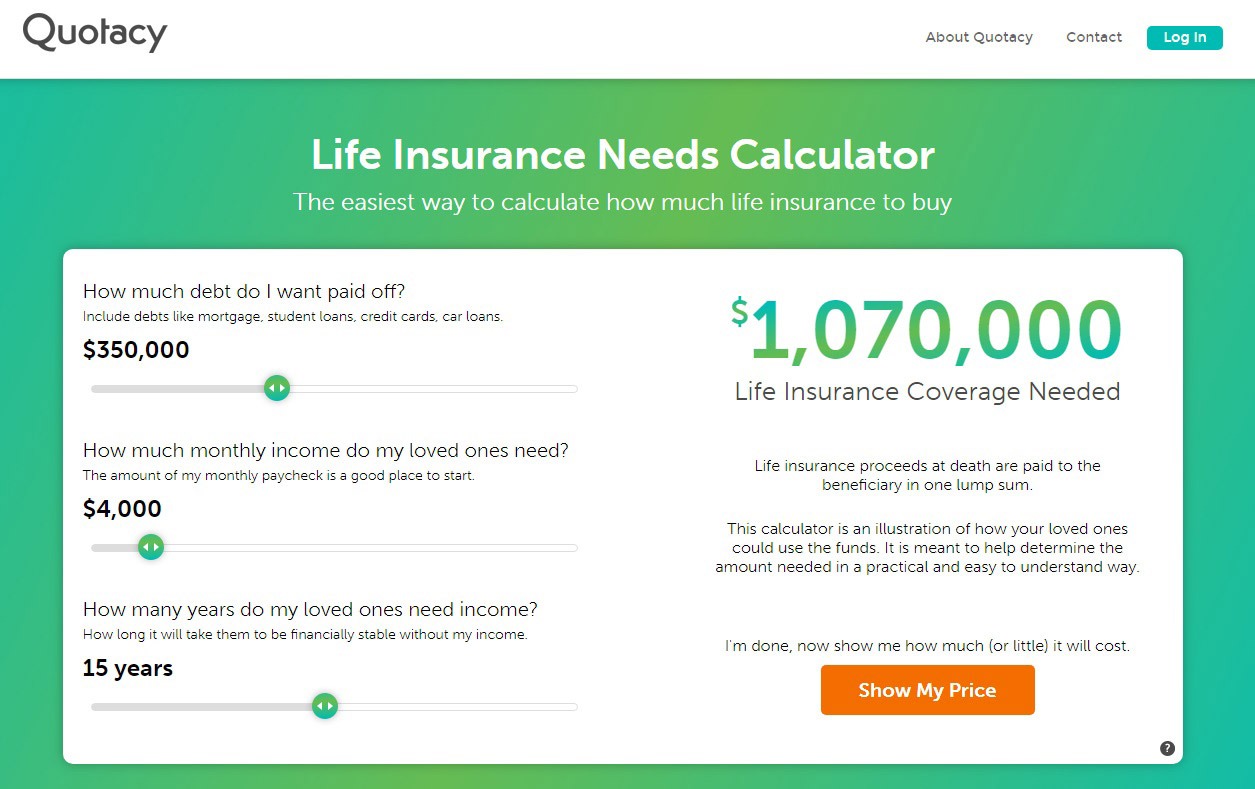

Life Insurance Calcula To In Just Five Simple Steps, This Tool Can Help

Myths About Life Insurance | Myths About Life Insurance Not To Believe

How Much Does Permanent Life Insurance Cost? | Trusted Choice

How to Buy Term Life Insurance at 52

Life Insurance Tools - Links to Everything You Need to Know About Life

Term Life Insurance Rates By Age Chart - blog.pricespin.net

Charts Quotes. QuotesGram

Infographic: Whole Life Insurance Can Be an Essential Piece of Your

Post a Comment for "Whole Life Insurance Estimate"