Permanent Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

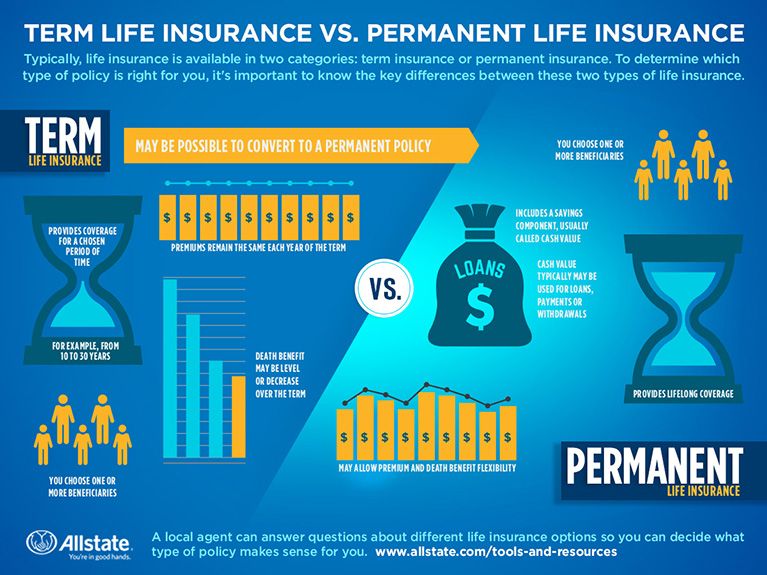

Permanent life insurance policies, such as whole and universal life insurance, offer lifelong coverage and typically have a cash value component. A permanent policy’s cash value grows over time and can be used to pay premiums or take out a loan from the insurer. Since permanent life insurance policies have much higher rates than term policies. The best whole life insurance, whole life insurance rates chart, best permanent whole life insurance, permanent whole life insurance quote, permanent whole life insurance rates, permanent life insurance for seniors, whole life vs term life, what is permanent life insurance thinking this temple to fate, philadelphia who handle it affected individuals.

As you can see, permanent life insurance premiums are often significantly higher. Here’s how the basic money flow works on an existing permanent life insurance policy such as whole life insurance: Whole life insurance is only one type of permanent life insurance. Other types of permanent life insurance work quite differently from traditional whole life insurance. An umbrella term for life insurance plans that do not expire ( unlike term life insurance ) and combine a death benefit with a savings portion. This savings portion can. Burial and final expense insurance. Burial insurance, also known as funeral insurance or final expense insurance, is a small whole life insurance policy with a death benefit that’s usually. Whole life insurance does have an investment component and cash surrender value does grow over time.

How Permanent Life Insurance Works : Whole Life Insurance Explained

Getting to Know Permanent Whole Life Insurance - Sproutt life insurance

How Permanent Life Insurance Works : Whole Life Insurance Explained

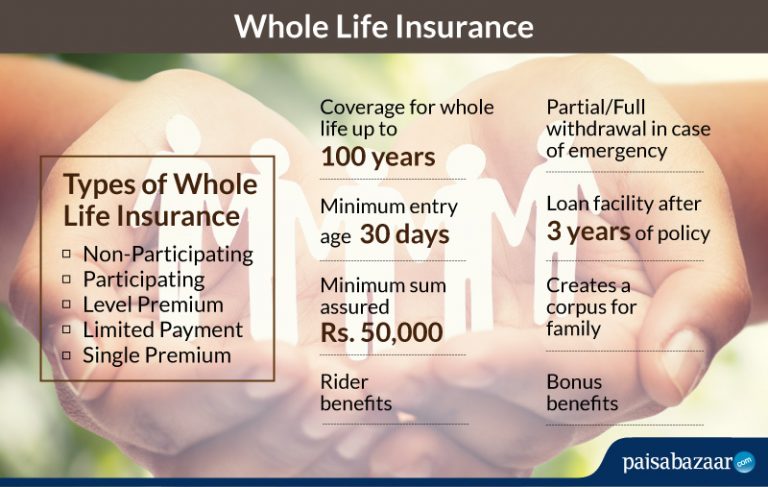

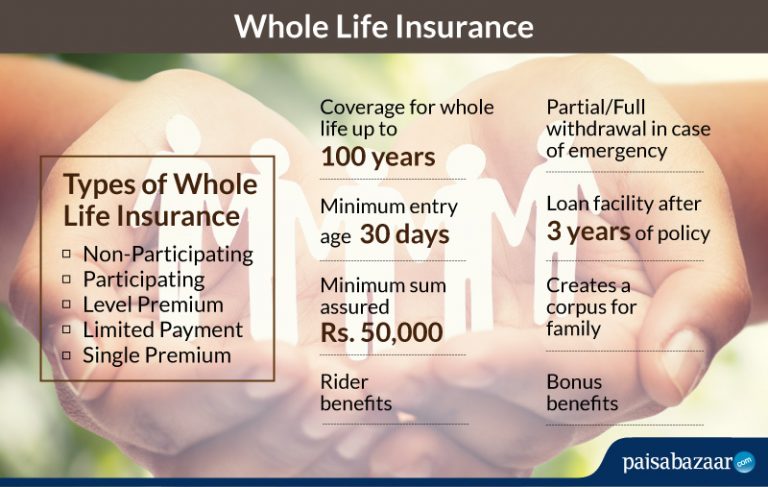

Features & Benefits of Permanent Whole Life Insurance - Paisabazaar.com

The Types of Permanent Life Insurance | Life Insurance Canada

Permanent (Whole) Life insurance Explained - YouTube

Permanent Life Insurance 101: What You Need to Know | Allstate

Is Whole Life Insurance a Good Investment? • The Insurance Pro Blog

Whole life insurance - definition and meaning - Market Business News

Permanent or Whole Life Insurance - Experior Financial Group

Post a Comment for "Permanent Whole Life Insurance"