Interest Sensitive Whole Life Policy

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

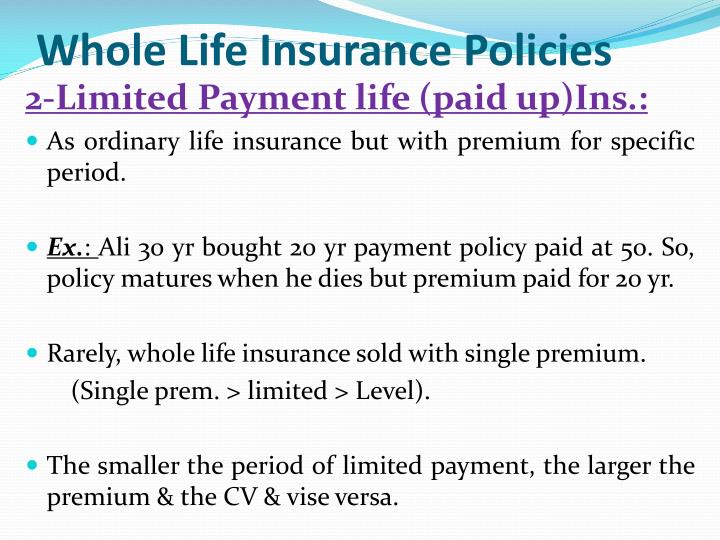

The policy differs from ordinary whole life in that it has a guaranteed maximum premium and guaranteed minimum cash value based on a guaranteed minimum interest rate. As with other cash value policies, the cash value account is credited with interest. The policy differs from ordinary whole life in that it has a guaranteed maximum premium and guaranteed minimum cash value based on a guaranteed minimum interest rate. As with other cash value policies, the cash value account is credited with interest.

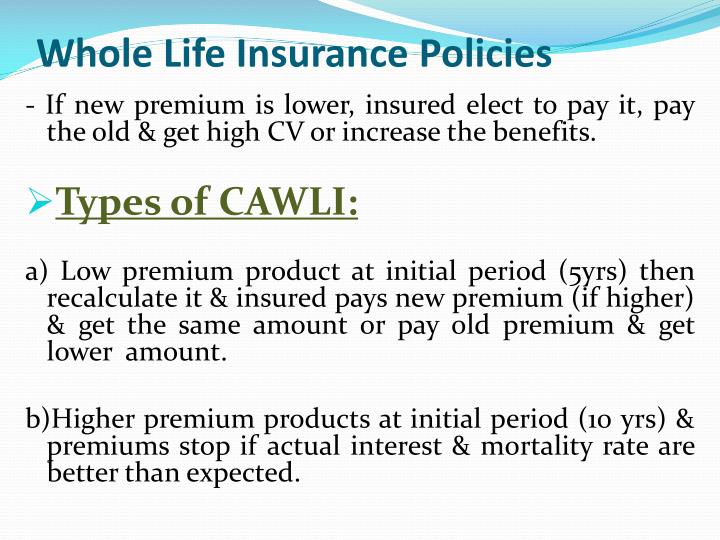

If the current interest rate (the interest rate being earned at the time of rate adjustment) exceeds the guaranteed. Interest sensitive life insurance is a form of permanent life insurance coverage that combines the benefits of whole life and universal life policies. The policy is sometimes referred to as an excess interest or current assumption whole life policy. As with most permanent life insurance policies, the policy will remain in effect. Webwhich of these arrangements allows one to bypass insurable interest laws? E and f are business partners. Each takes out a $500,000 life insurance policy on the other, naming himself as primary beneficiary. Whole life insurance policies have guaranteed cash values and provide lifetime coverage on the insured as long as premiums are paid, or sufficient cash values are. The insurance company can change the premium payment depending on how the interest rate changes.

Interest Sensitive Whole Life Insurance Definition - Thismylife Lovenhate

Interest Sensitive Whole Life Insurance Definition - Thismylife Lovenhate

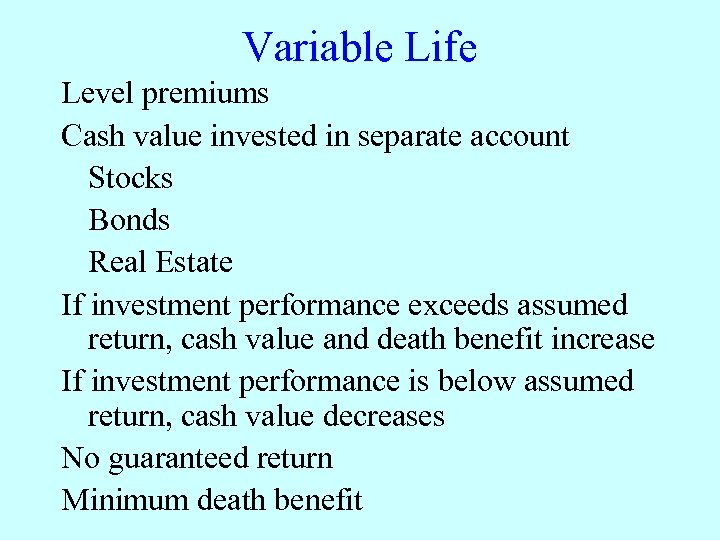

Today s Lecture — 15 Interest Sensitive and Variable

Today s Lecture — 15 Interest Sensitive and Variable

Today s Lecture — 15 Interest Sensitive and Variable

Whole Life Insurance Rates / Whole Life Insurance Company Risk Adjusted

AnnuityF: Annuity Versus Whole Life Insurance

PPT - Chapter 2 Life Insurance Policies “Whole Life Insurance

PPT - Chapter 2 Life Insurance Policies “Whole Life Insurance

Today s Lecture — 15 Interest Sensitive and Variable

Post a Comment for "Interest Sensitive Whole Life Policy"