High Cash Value Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

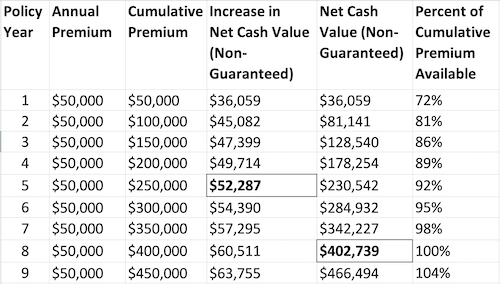

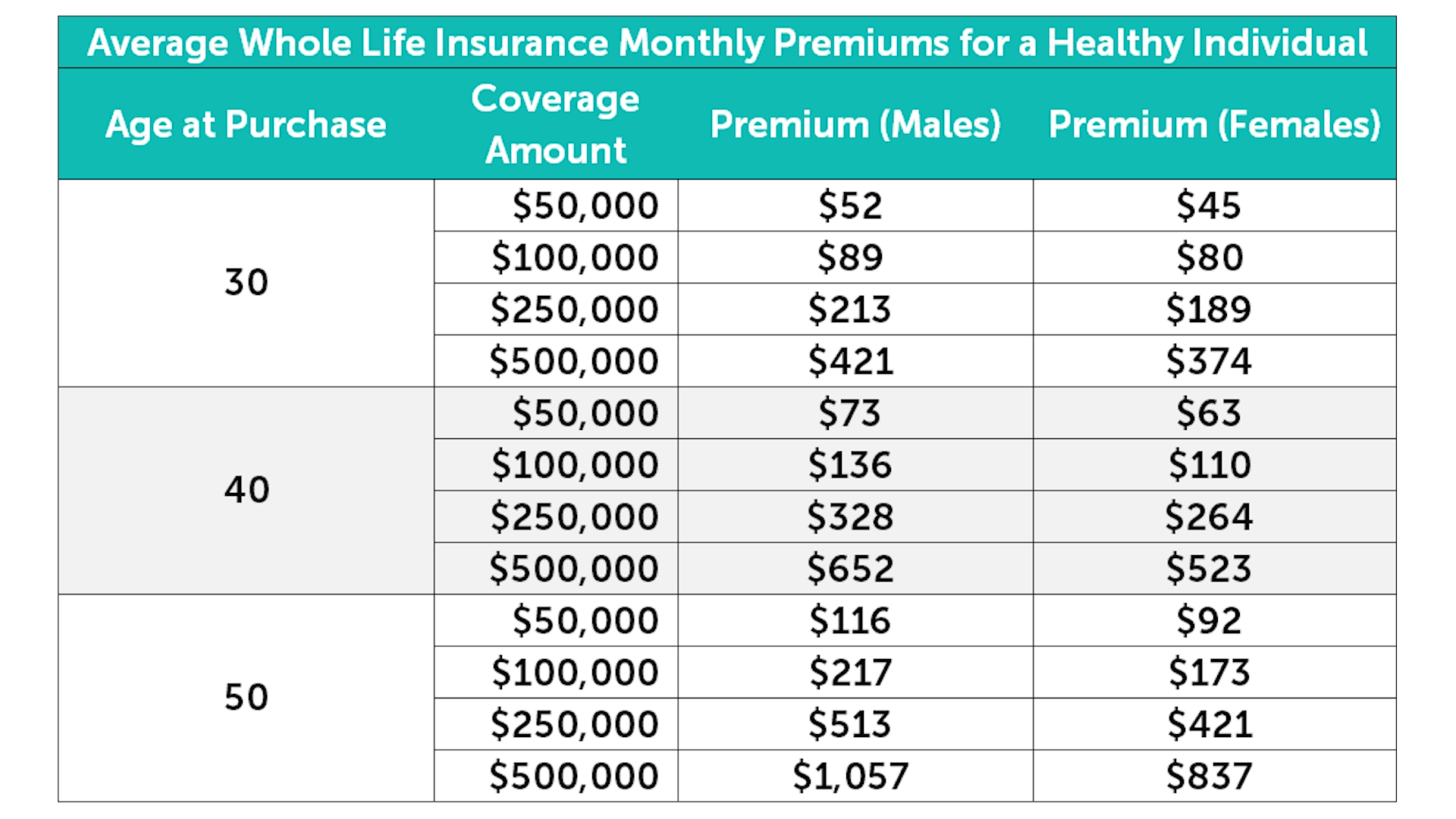

The cash value of whole life insurance is the basis by which the insurance company will loan to the policy owner. The insurance company will not lend the policy owner more than the total cash value of the policy owner’s life insurance policy. You can consult with your financial advisor or a wealth strategist for recommendations on when to. So let see the numbers for a healthy 35 year old male that wants to have cash value at the beginning of the policy:

Please refer to the product summary for more details. Singlife whole life comprises a base cover and an additional cover. Whole life insurance cash value chart. The cash value accrual rate varies based on the following factors: Annual premium of the contract; We love using our high cash value whole life insurance to store liquidity so we have money stored away we can leverage when an opportunity to improve our lives comes knocking. Which life insurance has the highest cash value? Whole life insurance is the best known and most common of these cash value policies. The insurer then pays a fixed return.

Do You Really Want That Overfunded Cash Value Life Insurance Policy?

How Can Whole Life Insurance Premiums Remain Level? – Bank On Yourself

High Cash Value Whole Life Insurance - YouTube

High Cash Value and Long-Term Growth - Whole Life Insurance

What's the Difference Between Term and Whole Life Insurance? | Quotacy

Whole life insurance - definition and meaning - Market Business News

How Does Whole Life Insurance Work Cash Value

Benefits of High Cash Value Life Insurance - YouTube

Why Cash Value Life Insurance is Bad

The Life Insurance Loan Process: A Step-by-Step Guide • The Insurance

Post a Comment for "High Cash Value Whole Life Insurance"