Whole Life Premiums

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

These policies have premiums that are lower than those of typical whole life policies upfront, then increases afterward. How is the premium modified? Graded premium whole life policies are a bit different from modified whole life policies. With graded premiums, the premiums gradually increase each year for a few years, and then they stay the same.

As long as you pay premiums, your beneficiary will receive the benefit amount upon your death. As mentioned above, whole life policies also build up “cash value” from part of the premium being invested. It’s possible to access that cash value as the funds grow. The following charts are for whole life insurance that is paid until age 100. There are other whole life policies that you pay for less time, they are called limited pay whole life. Next, you will find male and female rates. All the charts premiums are monthly payments. We quoted from age 20 to age 75. Whole life policies are designed to last a lifetime.

Whole Life Insurance - Guaranteed death benefit and premiums

Understanding How A Whole Life Insurance Works

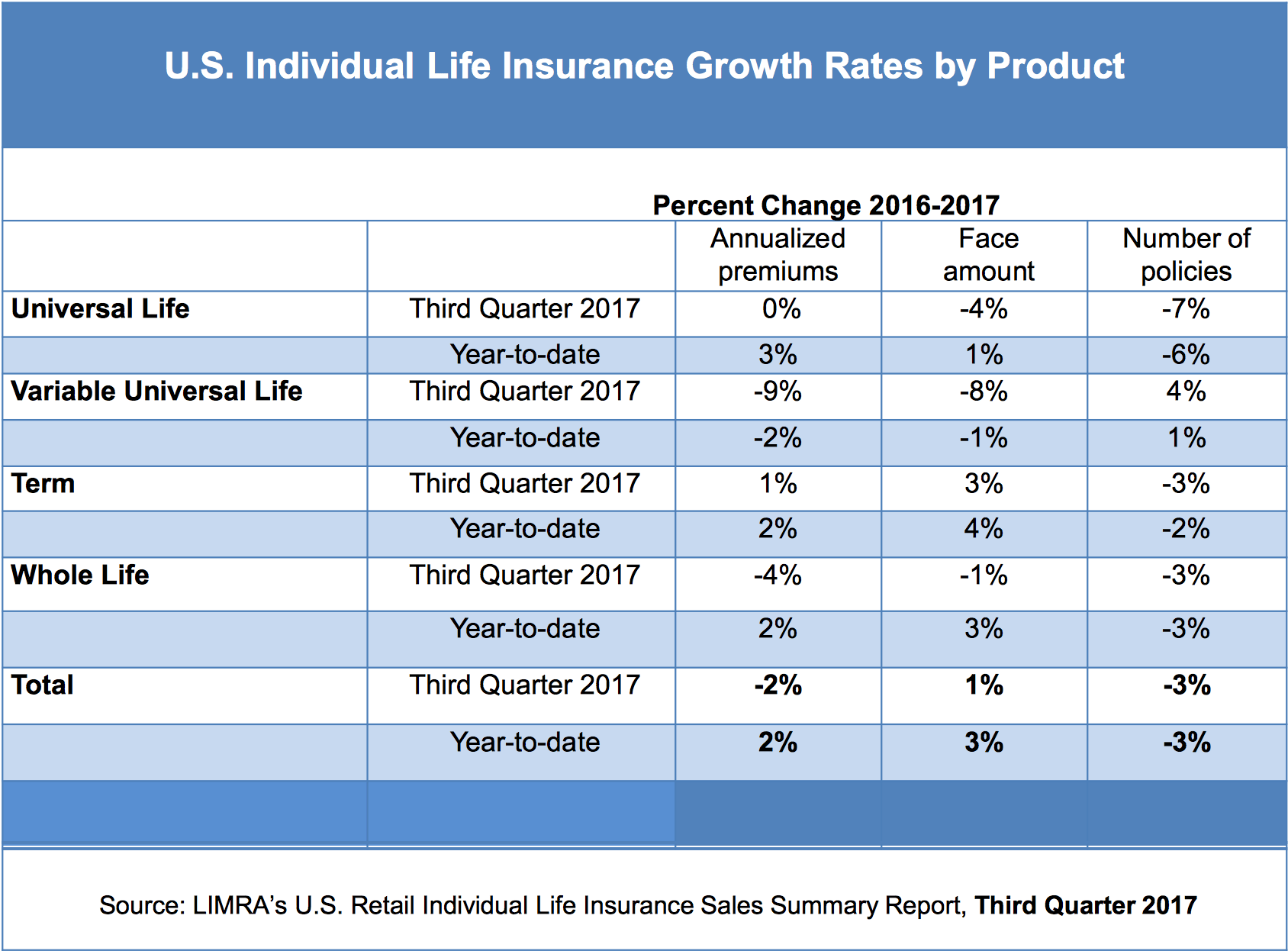

Life premiums fall 2% in 3Q as whole life sales drop for first time in

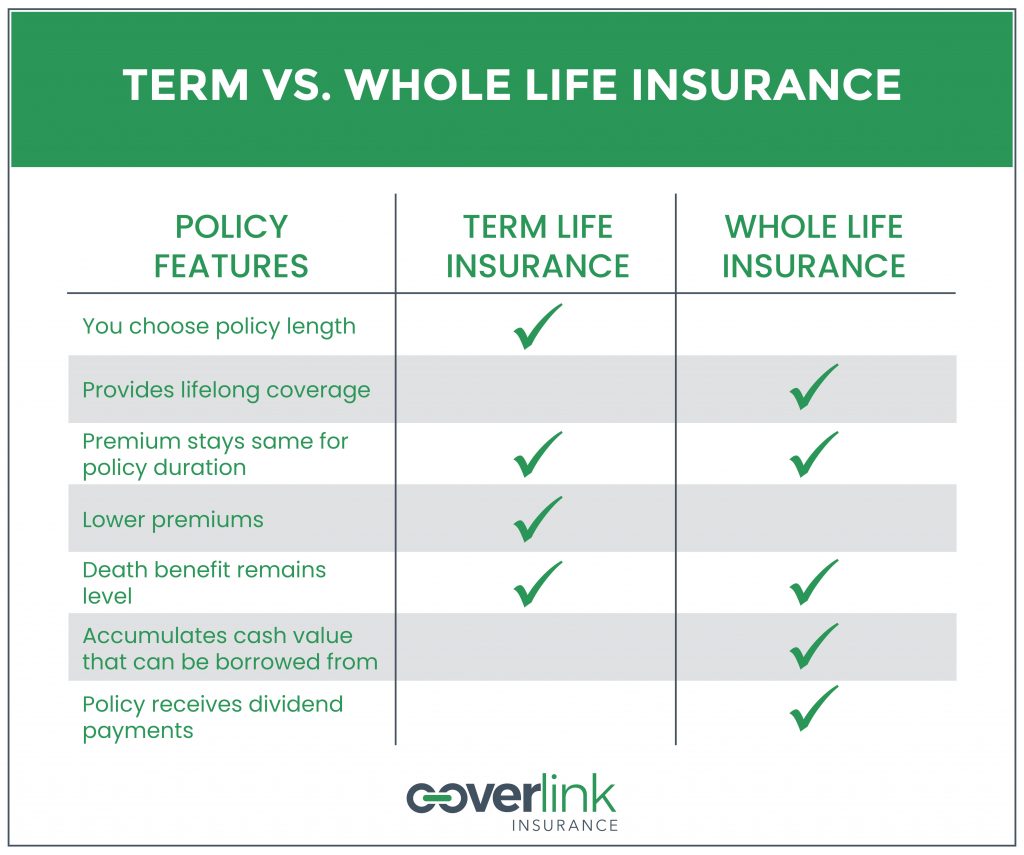

Term, Whole Life or Return of Premium Life Insurance: How to Choose

Whole Life Insurance Premiums - Understanding How A Whole Life

Whole life insurance rates by age - insurance

The Power of Single Premium Whole Life Insurance | Whole life insurance

Whole Life Insurance Investment Returns take too Long

Whole Life Insurance Premiums: How Flexible Are They?

Post a Comment for "Whole Life Premiums"