Whole Life Insurance Dividend

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

10 rowsmutual trust life insurance company has been around since 1904. The company markets itself as. Whole life insurance is a type of permanent or “cash value” life insurance that provides benefits for the “whole” of your life (versus term insurance that only lasts for a. Life insurance is unique in that you can withdraw.

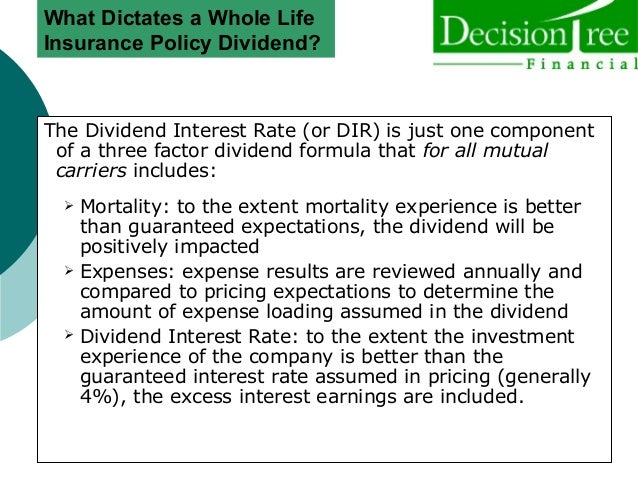

At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. The five dividend options. At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. Don’t worry, your choice isn’t. Dividends are payments permanent life insurance owners can get from their life insurance company each year. The dividend amount you’re paid is a percentage of your. The dividend amount often depends on the amount paid into the policy. For instance, a policy worth $50,000 that offers a 3% dividend will pay a policyholder $1,500 for the year. Annual dividend (for current policy year) $2,191.

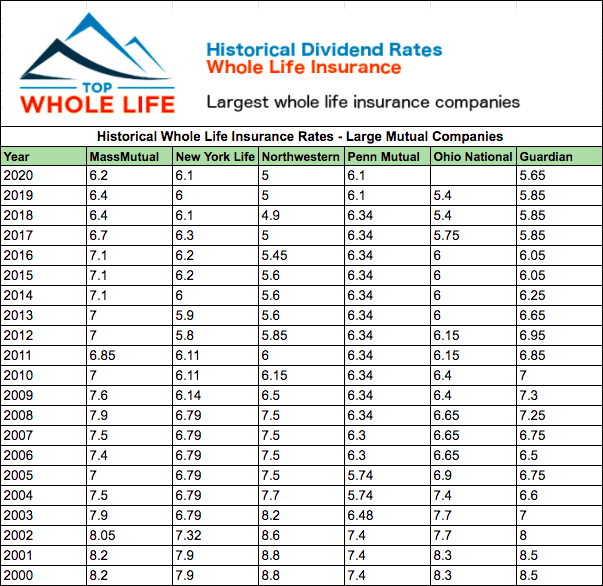

Whole Life Insurance Dividend Rate History [2019 Highest Dividends]

![Whole Life Insurance Dividend Whole Life Insurance Dividend Rate History [2019 Highest Dividends]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2018/09/Historical-Whole-Life-Insurance-Dividend-Rates-Graphic-V2.png)

Whole Life Insurance Dividend Rates History | Get A Quote

Dividends from Whole Life Insurance Explained - BankingTruths.com

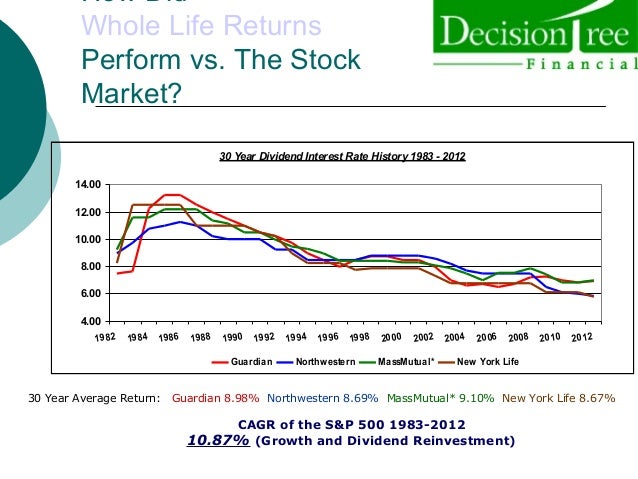

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Dividends from Whole Life Insurance Explained - BankingTruths.com

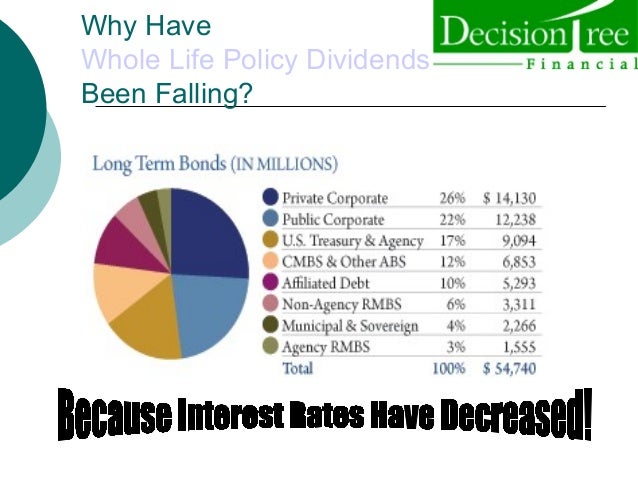

Whole Life Insurance Dividend Rates History | Get A Quote

Whole life insurance dividend rate of return history

Understanding Whole Life Insurance Dividend Options

Whole life insurance dividend rate of return history

Whole life insurance dividend rate of return history

Post a Comment for "Whole Life Insurance Dividend"