Guaranteed Cash Value Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

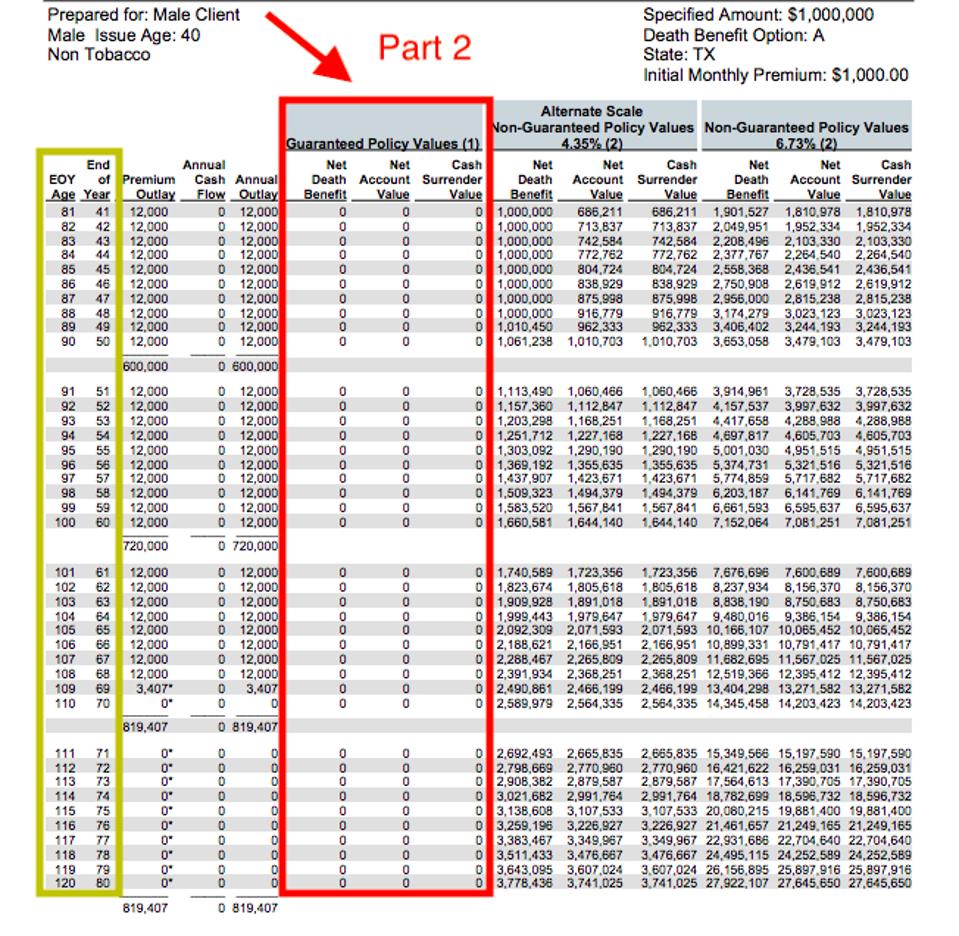

Webby the end of year five, for example, you will have paid a total of $45,300 in premiums, and built a cash value of $26,340 over that same period. And you have the guaranteed $500,000 death benefit. Not a bad investment. After 30 years, the cash value growth totaling $276,040 would exceed the amount paid in premiums $271,800.

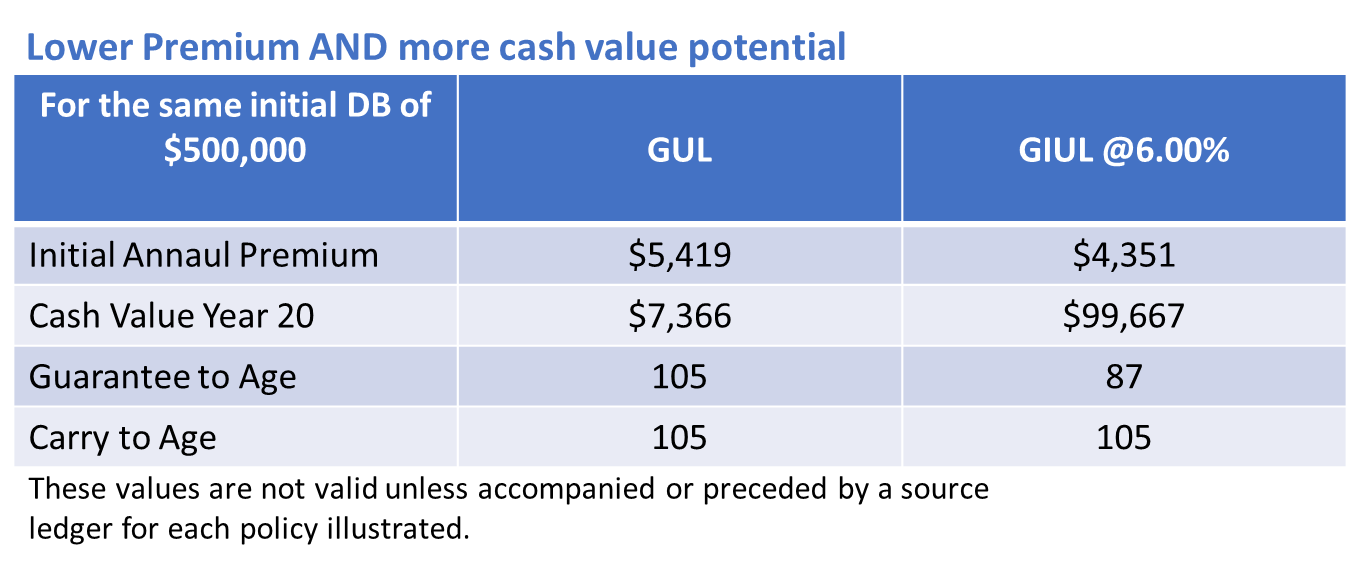

One portion for the death benefit, one portion for the insurer's costs. The policyholder can use. Weband with whole life insurance, cash value is guaranteed to grow in a tax deferred way and is unaffected by market volatility. Other policies — like universal life insurance — offer more flexibility over how cash value accumulates. Variable universal life offers the ability to get exposure to financial markets, but it also comes with. Webthe cash value in life insurance is simply what your policy is worth. It provides a savings component for the policy owner, and maintains a guaranteed rate throughout the lifetime of the policy so long as the premiums are paid. That potential growth is referred to as cash value accumulation. Cash value is also tax deferred, like an ira or a 401.

How Much Does Whole Life Insurance Cost? | Effortless Insurance

Whole Life Insurance Guaranteed Cash Value Gaffe

Whole Life Insurance Guaranteed Cash Value

Should You Get A Whole Life Insurance Policy? We Explain In Details How

The Power Behind Whole Life Guaranteed Cash Value

The Risks Of Cash Value Life Insurance

How Long Does It Take For Whole Life Insurance To Build Cash Value

Life Insurance with Guarantee and Cash Value Accumulation – Spiritenna

Explaining the Cash Value of Whole Life Insurance - Sproutt life insurance

Post a Comment for "Guaranteed Cash Value Life Insurance"