Cost Of Whole Life Insurance By Age

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

Average cost of term life insurance by age. If you use tobacco or have health issues the rate will be higher. For example, the average life insurance quote only increases by 6% between ages 25 and 30, but it jumps much higher between ages 60 and 65 — an average increase of 86%, or $275 per month. Average monthly rate (nonsmoker) average monthly rate (smoker) 25.

Again, these rates are for healthy individuals with no significant health problems. But some insurers give you the option to pay your premium in full upfront, or over 10, 15 or 20 years. To help you compare costs, we've included sample rates for a range of payment options below. Aaa members save 10% on monthly premiums for whole life insurance, which builds cash value with rates that never change. It can assist with final expenses and debts, supplement a term life insurance policy, and provide additional income. These sample rates reflect average premiums for both males and females: The story is similar for women. A $250,000 death benefit amount can be obtained for a $53 monthly premium as you start kindergarten. At 80 years old that number goes up to $1,632 per month!

Whole life insurance rates by age - insurance

Average Cost & Benefits of Direct Purchase Life Insurance 2020

Whole Life Insurance Rates - METRO BUCKS INSURANCE

Life Insurance for Seniors

Whole Life Insurance: How It Works and 2018 Rates

Average Cost Of Term Life Insurance By Age - blog.pricespin.net

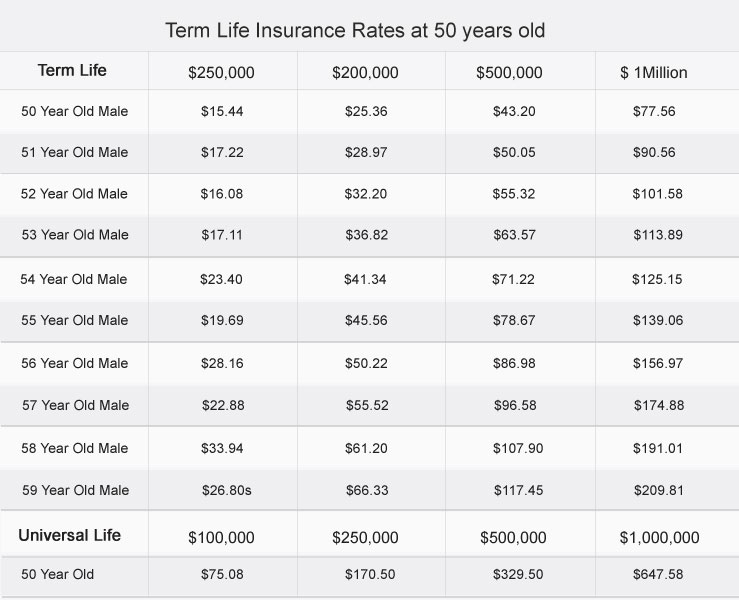

Advice on Term Life Insurance at 50 Years Old

Universal Life Insurance: Types and Rates

Pin on Budgeting tips

How Much Does Whole Life Insurance Cost? [Charts & 2019 Rates]

![Cost Of Whole Life Insurance By Age How Much Does Whole Life Insurance Cost? [Charts & 2019 Rates]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2019/01/Whole-Life-Insurance-Rates-Chart-Male.jpg)

Post a Comment for "Cost Of Whole Life Insurance By Age"