Cash Out Whole Life Insurance

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

For a policy that has a stated cash surrender value from the insurance agency as part of the policy: Overall tax liability = life settlement amount minus total amount paid into policy. How do you get money out of your whole life insurance cash value? There are several ways to get access to your whole life insurance cash value.

Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Term coverage only protects you for a limited number of. There are different ways to cash out life insurance and various reasons you may want to do so. Before cashing in a life insurance policy, it’s important to weigh the pros and. With a cash settlement, an investment company purchases your life insurance policy from you for more than its current cash value. However, the purchase price is less than the death benefit. There are at least five ways to cash out life insurance: Withdraw part of the cash value withdraw all of the cash value and surrender the policy borrow against the cash value use the cash value to pay premiums take advantage of living benefits The key differences between term vs.

Whole life insurance cash value chart - insurance

How Does Whole Life Insurance Work Cash Value

Explaining the Cash Value of Whole Life Insurance - Sproutt life insurance

Cashing Out Whole Life Insurance Policy

Cash Value Whole Life Insurance - YouTube

Cashing Out Whole Life Insurance Policy

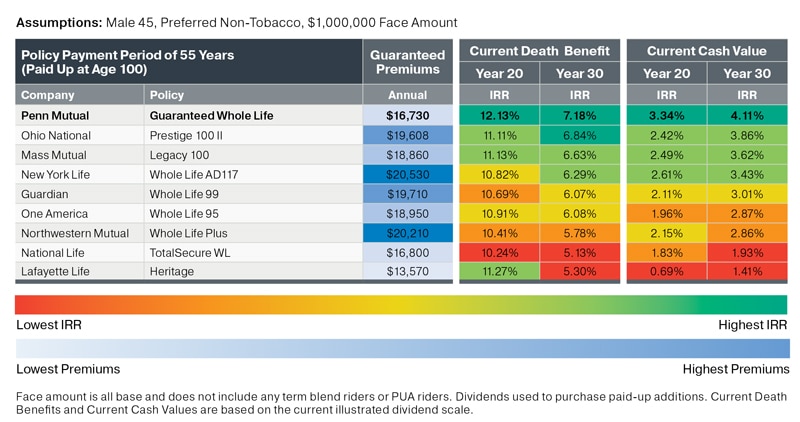

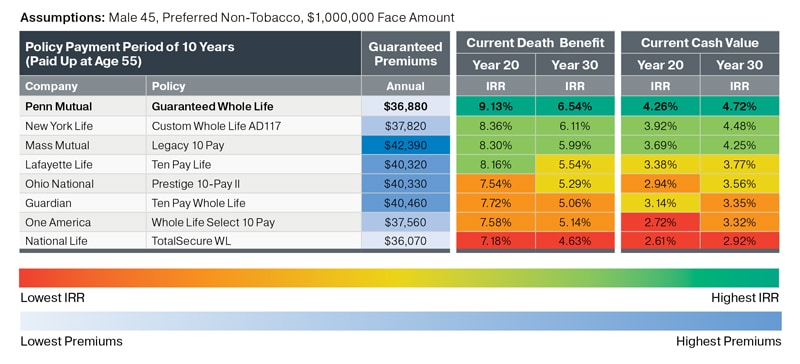

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Best Dividend Paying Whole Life Insurance for Cash Value & Why

How Long Does It Take For Whole Life Insurance To Build Cash Value

Post a Comment for "Cash Out Whole Life Insurance"