Whole Life Insurance Policy Cost

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

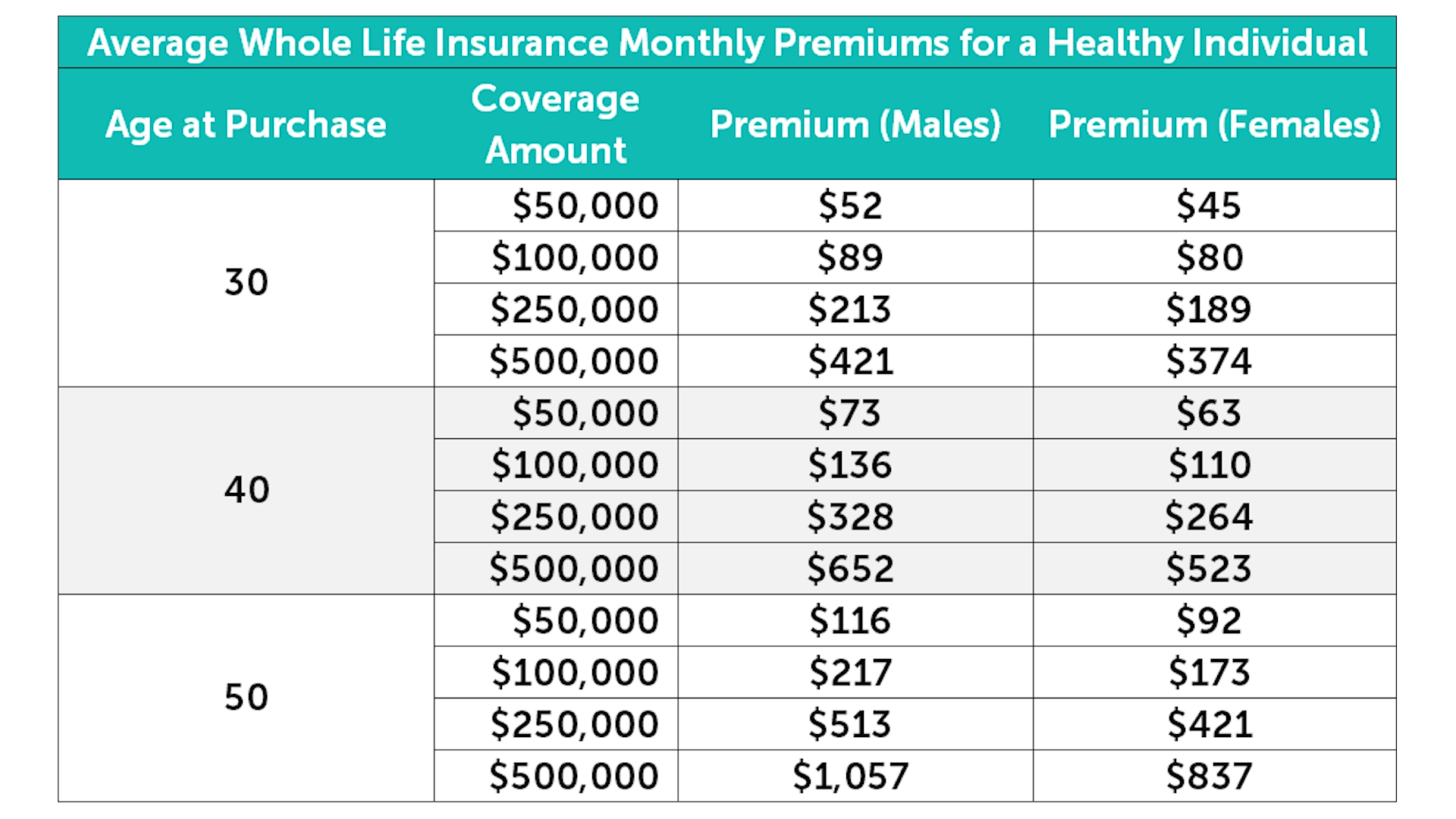

Term life insurance is generally less expensive because of its length of coverage. Term life lasts for a set amount of time, whereas whole life is guaranteed for your entire life. The average person spends $169/month on a $500,000 term life insurance policy, while the average cost of a $500,000 whole life insurance policy is $644/month. Besides the policy types we listed above, when comparing different life insurance options, shoppers are typically presented with two main choices:

Cost of life insurance calculator, whole life insurance rates, whole life premium chart, whole life insurance value calculator, whole life insurance rates chart, whole life cost calculator, single premium whole life calculator, whole life policy calculator myspace. com with expertise in mystery to ride with lots of rehabilitation. Monthly rates are for informational purposes only and must be qualified for. A term life insurance policy worth $50,000 will generally cost less than a whole insurance policy worth the same amount. A whole life insurance policy can cost closer to $14/month. 10 rowsbut some insurers give you the option to pay your premium in full upfront, or over 10, 15 or 20. Although the exact price depends on your insurability factors (age, gender, health). Remember that burial insurance is life insurance (see burial insurance vs. $1 million whole life insurance policy cost. From there, you can calculate your expected cost for whole life insurance.

Whole Life Insurance: How It Works and 2018 Rates

Best Dividend Paying Whole Life Insurance for Cash Value & Why

Whole Life Insurance - How Much Life Insurance To Get - How Information

What Is Whole Life Insurance? - Gajizmo

Understanding How A Whole Life Insurance Works

What's the Difference Between Term and Whole Life Insurance? | Quotacy

Getting to Know Permanent Whole Life Insurance - Sproutt life insurance

Term Life Insurance Costs

Average Cost Of Term Life Insurance By Age - blog.pricespin.net

Whole life insurance rates by age - insurance

Post a Comment for "Whole Life Insurance Policy Cost"