Whole Life Insurance For Dummies

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

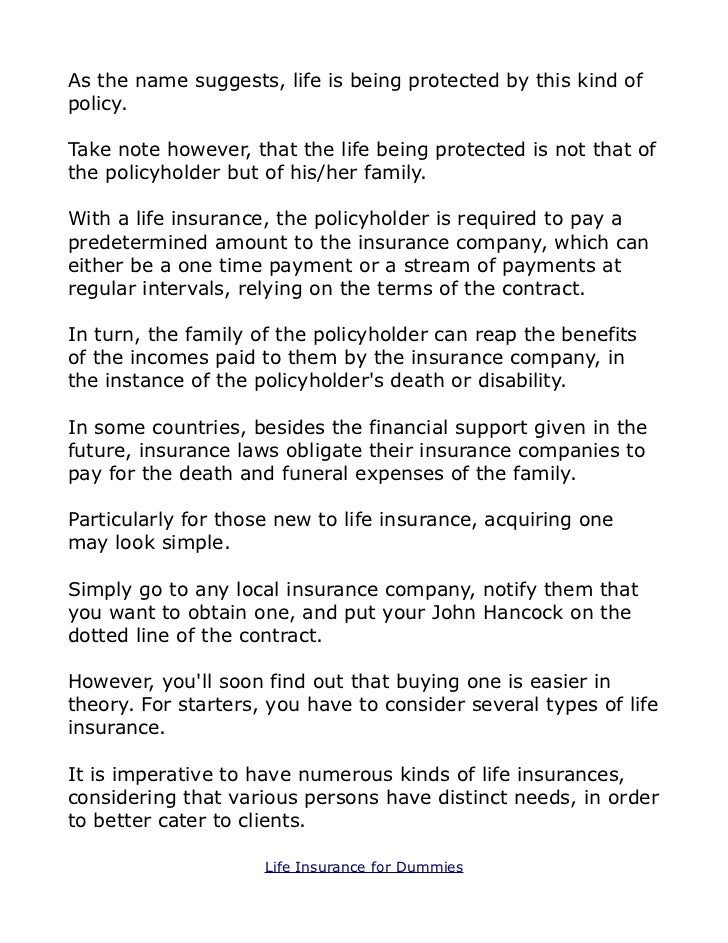

The policy’s death benefit could be used to create an investment income stream. $1,000,000 earning 6% = $60,000 / year. A whole life insurance policy can help you leave a significant inheritance for your dependents. Policyholders can avail tax benefits upon purchasing a whole life insurance policy.

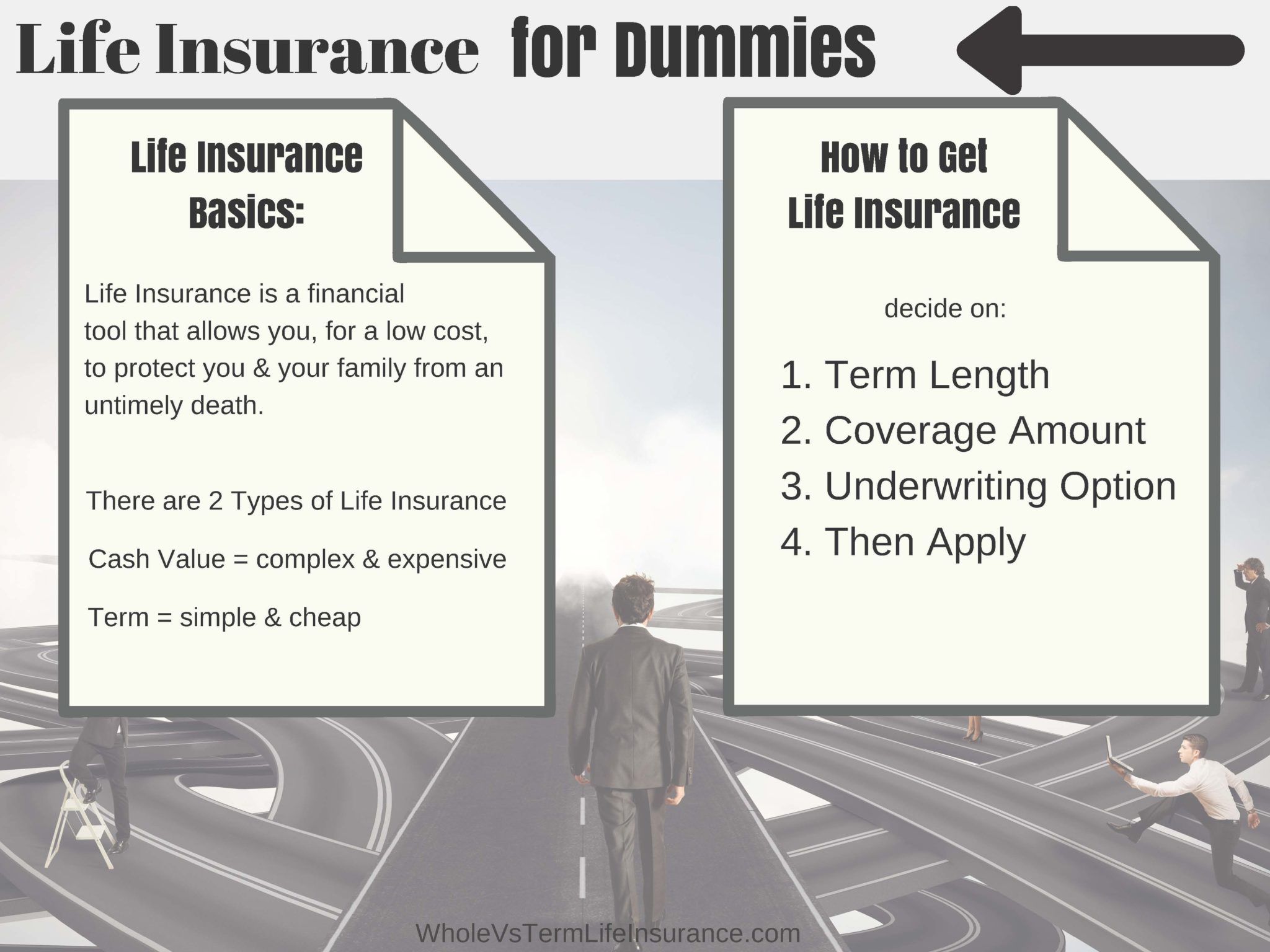

Many whole life insurance plans also serve as an investment/savings instrument, thus providing the. Some of the life insurance 101 basics you need to know are the main differences between term and permanent life insurance. Pays a death benefit to your beneficiary only if you die during the term of an active policy until age 95. Pays a death benefit to your beneficiary regardless of when you die as long as. Life insurance isn't just for dummies. Term life insurance is temporary. It provides coverage for a specified amount of time, known as the term. Life insurance companies offer their customers term life because it is less expensive than a permanent life insurance product like whole life. Whole life insurance is a policy that is with you until your death.

Life Insurance for Dummies - Whole Vs Term Life

Life Insurance For Dummies | Teach Besides Me

Whole life policies for dummies: are they a good way to insure your family?

Life Insurance for Dummies - Whole Vs Term Life

Insurance For Dummies Pdf Download

Life Insurance for Dummies - Whole Vs Term Life

Life Insurance for Dummies: A Helpful Beginners Guide - Top Quote Life

Life insurance for dummies

Teach Besides Me: Life Insurance For Dummies

Life Insurance For Dummies | Teach Besides Me

Post a Comment for "Whole Life Insurance For Dummies"