Life Insurance That Builds Cash Value

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

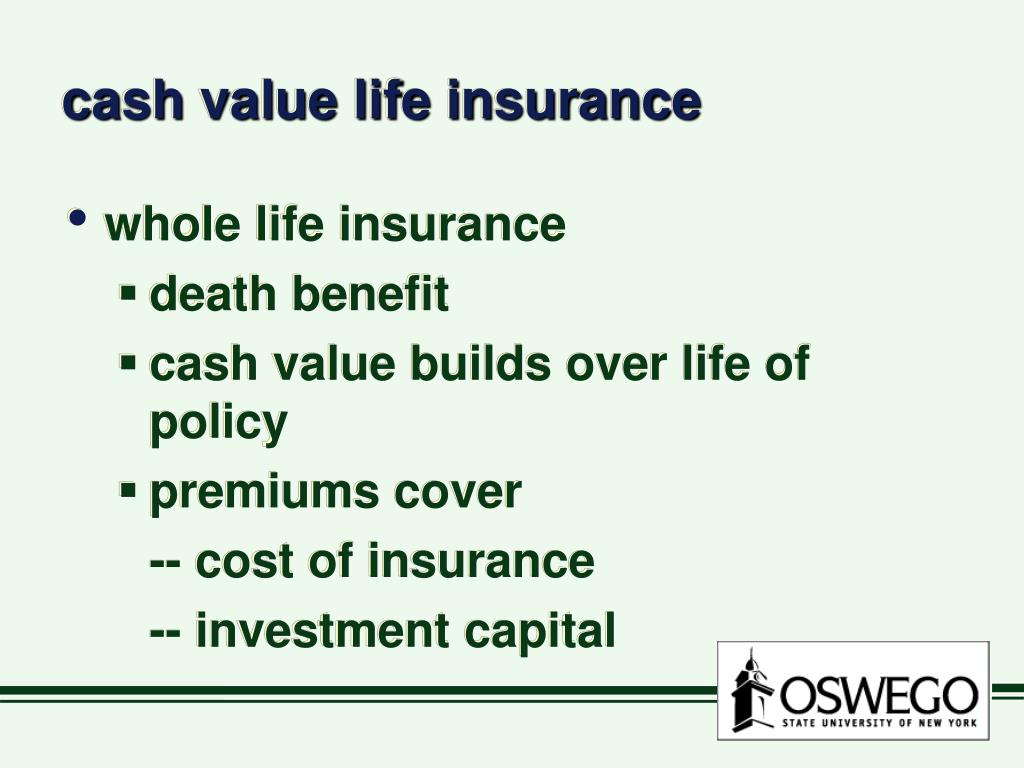

The reason cash value life insurance is such a good product is because they have what we call the triple tax advantage. Pros and cons of cash value insurance: First, this is a deep dive into whole life cash value, but we don’t want you to waste your time. You can skip ahead or read all the details in our review.

#3 new york life. Permanent life insurance offers both death benefit coverage and a cash value account. Find out how to make the most out of the cash value in whole life or indexed universal life insurance plans. The life insurance company will invest your premiums, enabling it to provide the policy cash values. The way cash values grow depends on the type of policy purchased. The policy owner can access the policy cash value through a loan or withdrawal, depending on the type of policy. If you take out a loan, the life insurance company will charge. The cash value of a life insurance policy is usually equal to the death benefit minus any outstanding loans or other debts against the policy. Some insurers charge a surrender fee if the policy is cashed in early.

How Long Does It Take For Whole Life Insurance To Build Cash Value

Cash Value Life Insurance [Top 10 Best Companies and Top 5 Benefits]

![Life Insurance That Builds Cash Value Cash Value Life Insurance [Top 10 Best Companies and Top 5 Benefits]](https://www.insuranceandestates.com/wp-content/uploads/Cash-Value-Life-Insurance-1-e1541697174316.jpg)

Life Insurance That Builds Cash Value : Compare Online Life Insurance

How Long Does It Take For Whole Life Insurance To Build Cash Value

Gerber Life Insurance Grow-Up Plan TV Commercial, 'Builds Cash Value

Life Insurance That Builds Cash Value : Compare Online Life Insurance

How Cash Value Builds in a Life Insurance Policy | Investopedia

How Cash Value Builds in a Life Insurance Policy - The Entrepreneur Fund

Gerber Life Insurance Grow-Up Plan TV Commercial Builds Cash Value

Life Insurance That Builds Cash Value : Compare Online Life Insurance

Post a Comment for "Life Insurance That Builds Cash Value"