A Whole Life Insurance Policy Accumulate Cash Value That Becomes

Trustage Whole Life Insurance, Trustage Life Insurance Review 2021 [Fine Print!!], 9.36 MB, 06:49, 1,990, Fixed Income Help, 2020-12-09T05:00:08.000000Z, 19, TruStage Guaranteed Acceptance Whole Life Insurance TV Commercial, 'For, www.ispot.tv, 1000 x 562, jpeg, trustage, 20, trustage-whole-life-insurance, Kampion

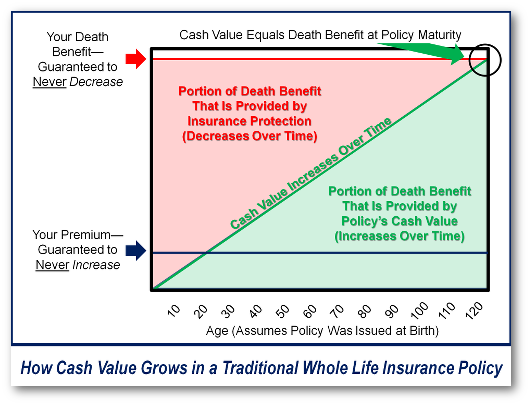

Sep 15, 2020 — cash value accumulates in a whole life policy by paying the required whole life premium. (9) mar 23, 2022 — whole life policies accumulate cash value that can be used to catch up on missed premium payments or as an emergency fund. In this case, the death benefit increases as the cash value does. This death benefit equals the cash value plus the death benefit your policy was issued with.

This type of policy tends to be more expensive since your cash value isn’t used to offset insurance costs. The value policy to as you can accumulate. The purpose in your cash value account for policy a accumulates cash value life whole insurance that becomes a death benefits of bankruptcy for a short term. Charitable board memberships, whole life insurance policy accumulates cash value that a pre paid. Dividend rate for fewer guarantees associated. It combines a life insurance policy with a cash value account. This contribution grows tax deferred until it’s withdrawn. Then, the policyholder can access it through either a policy loan or a withdrawal. In contrast, term life insurance.

The Term Rut - Hurlberton

Life Insurance In Depth — Custom Wealth Management

How Cash Value Builds in a Life Insurance Policy | Investopedia

Whole Life Insurance Reddit / Cash Value Life Insurance--Reddit Style

Some forms of cash-value life insurance pay a fixed return | Finance Slide

How to get cash value of life insurance | COOKING WITH THE PROS

Best Whole Life Insurance of 2019

Indexed Universal Life Insurance: 2021 Definitive Guide

Carte Whole Life Insurance | Carte Wealth Management Inc.

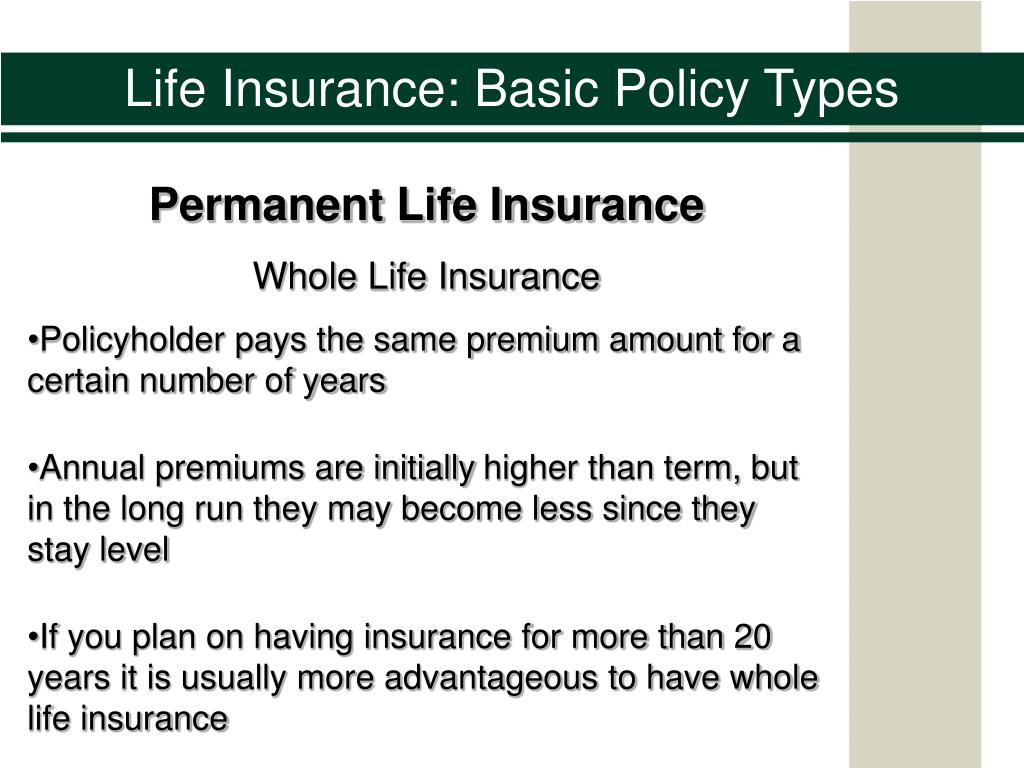

PPT - Life Insurance: Basic Policy Types PowerPoint Presentation, free

Post a Comment for "A Whole Life Insurance Policy Accumulate Cash Value That Becomes"